What’s Oracle’s Value Proposition in the US Software Space?

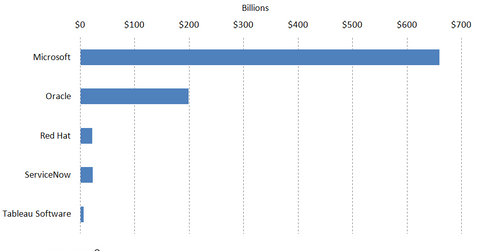

As of December 26, 2017, Microsoft (MSFT), with a market cap exceeding $650 billion, continued to be the largest software player. Oracle came in second.

May 3 2021, Updated 11:19 a.m. ET

Oracle’s scale in systems software

In the previous article, we discussed analysts’ recommendations for Oracle’s (ORCL) stock following its fiscal 2Q18 earnings announcement. As of December 26, 2017, Microsoft (MSFT), with a market cap exceeding $650 billion, continued to be the largest software player. Oracle came in second. Recently, Oracle stock has suffered, and its market capitalization fell below $200 billion. With market caps of ~$22 billion each, ServiceNow (NOW) and Red Hat (RHT) placed third and fourth, while Tableau Software (DATA) held fifth place.

Valuation and dividend yields

In this article, we’ll compare Oracle’s and peers’ EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiples. EV-to-EBITDA is a vital valuation multiple, as it considers the valuation of the overall company, not just its equity.

On December 26, Oracle was trading at a forward EV-to-EBITDA multiple of ~9.9x. In comparison, Microsoft’s multiple was ~14.33x, and Red Hat’s was ~26.1x. Microsoft’s forward annual dividend yield was ~1.9% as of December 26, higher than Oracle’s ~1.6%. Dividend payout indicates how much a company pays in dividends in relation to its stock price. Oracle stock’s fall has increased its dividend yield. Dividends are important for many investors, as they view it as steady income, especially amid increasing uncertainty and volatility.