Where Does BluVector Fit in Comcast’s Strategy?

Comcast’s (CMCSA) recent purchase of cybersecurity company BluVector for an undisclosed amount looks like a promising opportunity for Comcast.

March 8 2019, Updated 4:08 p.m. ET

BluVector provides protection for enterprises

Comcast’s (CMCSA) recent purchase of cybersecurity company BluVector for an undisclosed amount looks like a promising opportunity for Comcast. BluVector specializes in the enterprise security market, where it serves companies and government agencies.

According to Comcast, its first goal will be to grow BluVector’s existing business. Comcast also plans to leverage BluVector’s technology and expertise to build new cybersecurity products.

A $300 billion opportunity in the cybersecurity market

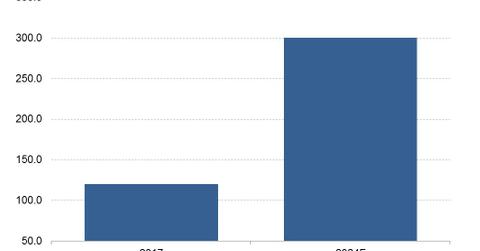

With its range of solutions and customer network, BluVector is bringing a new stream of revenue to Comcast. BluVector could also make Comcast a more diversified company. Amid cord-cutting, traditional media companies need to create new revenue streams, and cybersecurity could be a good bet for Comcast. According to Global Market Insights, the global cybersecurity market could grow to $300 billion by 2024 from $120 billion in 2017, driven by companies investing to secure data and applications they are hosting on remote data centers.

Revenue jumped 26% at Comcast

Comcast generated $94.5 billion in revenue last year, with its revenue rising 26.1% YoY (year-over-year) to $27.8 billion in the fourth quarter. Meanwhile, revenue was mostly flat YoY at Walt Disney (DIS) but rose 5.8% YoY at 21st Century Fox (FOX). Charter Communications’ (CHTR) revenue grew 5.9% YoY, while Dish Network’s (DISH) fell 5.1% YoY.