Territorial Tax System: Important for US Semiconductor Companies?

The semiconductor industry welcomed the Tax Cuts and Jobs Act that President Trump signed into law on December 22, 2017.

Jan. 4 2018, Published 11:41 a.m. ET

Semiconductor industry welcomes US tax reforms

The semiconductor industry welcomed the Tax Cuts and Jobs Act that President Trump signed into law on December 22, 2017. Although the final corporate tax rate was higher than what was originally proposed, the overall reforms could bring US semiconductor companies to a level playing field with its overseas counterparts.

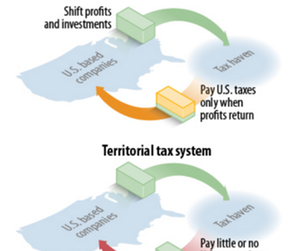

Territorial tax system

The tax act also changes the US Tax Code from a worldwide system in which profits earned by US-based companies around the world are taxable when that money is repatriated to the United States to a territorial tax system. Under the territorial tax system, companies are exempt from the home country’s tax on most or all of their overseas profits.

The new act provides a 100% tax exemption on dividends received by US companies from their foreign subsidiaries in which they have at least a 10% stake. The act allows a minimum 10.5% tax on the foreign profits of US companies. This 10.5% rate includes tax collected by local authorities where the profit is earned.

That could benefit Qualcomm (QCOM) the most since it earns more than 90% of its revenue from outside the United States. Others that could benefit include Nvidia (NVDA), Applied Materials (AMAT), Texas Instruments (TXN), and Micron Technology (MU), which earns more than 80% of its revenue overseas.

Alternative minimum tax and interest provision

The tax act has also eliminated the corporate AMT (alternative minimum tax). The AMT is a parallel system that calculates taxable income after limiting or eliminating certain deductions, credits, and other tax preference items. A flat rate of 20% is applied to taxable income. Semiconductor companies use R&D (research and development) expense deductions to reduce their tax bills.

The AMT is triggered when several tax breaks bring a company’s taxes too low. The AMT aims to prevent corporations from avoiding taxes altogether by misusing deductions and credits. Under the previous 35% maximum corporate tax rate, the AMT rarely applied since most corporations faced a higher tax.

The corporate tax rate has been reduced to 21%. The tax act eliminated the corporate AMT to give a tax advantage to companies.

The impact of the above reforms could be visible in semiconductor companies’ 2018 earnings. Next, we’ll look at the developments expected in AI (artificial intelligence) in 2018.