How Sinclair Broadcast Intends to Move Forward

Sinclair Broadcast Group’s (SBGI) revenue grew 23% in 2016 and 3% in 9M17. In 2016, it acquired several television stations and the Tennis Channel.

Jan. 26 2018, Updated 9:03 a.m. ET

Why did revenue fall?

Sinclair Broadcast Group’s (SBGI) revenue grew 23% in 2016 and 3% in 9M17. In 2016, it acquired several television stations and the Tennis Channel. It also introduced the Circa.com website, rebranded its digital agency solutions group, and entered into agreements with Fox for the renewal of affiliations.

However, its 9M17 results were affected by the hurricanes, loss of certain technical school advertisers, and certain non-recurring adjustments.

What led to the fall in diluted EPS growth?

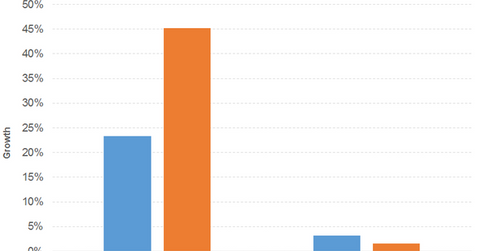

Sinclair Broadcast Group’s cost of revenue increased 28% in 2016 and 10% in 9M17. Gross profit grew 20% in 2016 before falling 2% in 9M17. Operating expenses rose 9% in 2016 before decreasing 4% in 9M17. As a result, operating income grew 43% in 2016 and 3% in 9M17. Other expenses increased in 2016 before decreasing in 9M17. Interest expenses drove expenses. All of that translated into a 45% and 2% growth in diluted EPS (earnings per share) for 2016 and 9M17, respectively. Share buybacks enhanced the EPS numbers for 2016.

Dividend yield and price performance

Sinclair has a good free cash flow position. Its dividend yield decreased in 2017 due to a lower rate of increase in dividend and higher price gains.

Its dividend yield of 1.8% and PE (price-to-earnings) ratio of 15.3x compare to a sector average dividend yield of 2.2% and a PE ratio of 25.0x. It rose 2%, 13%, and 5% in 2016, 2017, and YTD (year-to-date), respectively.

Going forward

Last year marked the launch of TBD and Charge! networks and the end of Sinclair’s spectrum auction. It also acquired Bonten Media Group Holdings and entered into agreements with YouTube, Sony Vue, Fox Broadcasting, and CBS for content and distribution. The company’s subsidiary entered into an agreement for the design of a chip for ATSC 3.0 fixed and mobile reception. It expects the acquisition of Tribune Media to close in early 2018.

ETFs

The WisdomTree US SmallCap Dividend Growth ETF (DGRS) has a PE ratio of 17.6x and a dividend yield of 2.4%. The First Trust Mid Cap Value AlphaDEX ETF (FNK) has a PE ratio of 14.9x and a dividend yield of 1.4%.