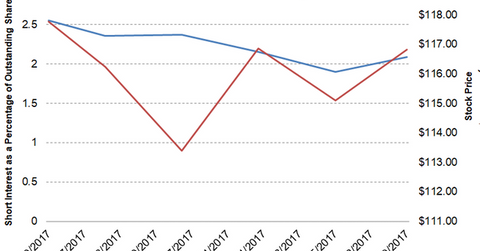

PPG Industries: Short Interest before Its 4Q17 Earnings

As of December 29, PPG Industries’ short interest as a percentage of outstanding shares stood at 2.10%. Its short interest fell from 2.55% as of October 20.

Jan. 15 2018, Updated 7:33 a.m. ET

PPG Industries’ short interest

The latest data as of December 30, 2017, shows that PPG Industries’ (PPG) short interest has fallen since its 3Q17 earnings were announced on October 19, 2017. It shows that the bearish sentiment in the stock fell and the stock price could go up. As of December 29, 2017, PPG Industries’ short interest as a percentage of outstanding shares stood at 2.10%. Its short interest fell from 2.55% as of October 20, 2017.

Why did the short interest fall?

PPG Industries’ positive news of a new $2.5-billion share repurchase program, new product launches, and new investments and acquisitions caused the short interest to fall. Looking at analysts’ recommendations, if PPG Industries can deliver good earnings in 4Q17, the short interest might fall more. If its earnings miss the estimates, PPG Industries’ short interest could increase.

Short interest ratio for PPG Industries and its peers

In terms of the number of shares, PPG Industries’ short interest was at ~5.32 million shares. Its average trading volume is ~1.2 million shares. PPG Industries’ short interest ratio is ~4.0x, which indicates that it requires four days to cover all of the short positions. Below are the short interest ratios for PPG Industries’ peers:

- Sherwin-Williams (SHW) – the short interest was 964,570 shares. The average number of shares traded is 455,000. The short interest ratio is ~2.10x, which indicates that it will take two days to cover all of the short positions.

- Axalta (AXTA) – the short interest is at 7.24 million, while the average number of shares traded is at 3.60 million. It will take two days to cover Axalta’s short positions.

- RPM International (RPM) – the short interest ratio stands at ~4.0x. It will take four days to cover all of the short positions.

Investors can hold PPG Industries indirectly by investing in the Vanguard Materials ETF (VAW). VAW has invested 3.40% of its portfolio in PPG Industries as of January 11, 2018.