How Do Pizza Companies’ Valuation Multiples Compare?

Due to the high visibility of their earnings, we’ve opted to use the forward PE (price-to-earnings) multiple for our valuation analysis of the pizza companies in this series.

Jan. 4 2018, Updated 10:30 a.m. ET

Valuation multiple

Due to the high visibility of their earnings, we’ve opted to use the forward PE (price-to-earnings) multiple for our valuation analysis of the pizza companies in this series.

The forward PE multiple is calculated by dividing a company’s stock price by analysts’ earnings estimates for it over the next four quarters.

Comparing forward PE multiples

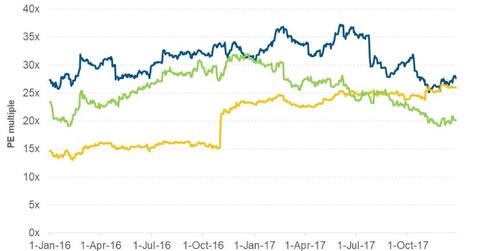

In the graph above, we can see that Domino’s Pizza (DPZ) has been trading above its peers’ valuation multiples. The company’s aggressive expansion policy and higher same-store sales growth (or SSSG) have allowed it to trade at a higher forward PE multiple than its peers.

On December 26, 2017, Domino’s was trading at a forward PE multiple of 27.7x compared to its level of 30.3x before the announcement of its 3Q17 earnings. The deacceleration in the SSSG of Domino’s company-owned restaurants in domestic markets made investors skeptical of its future earnings, leading to a fall in its stock price and valuation multiple.

Domino’s was followed by Yum! Brands (YUM), which was trading at a forward PE multiple of 25.9x on December 26. Before the announcement of its 3Q17 earnings, the company was trading at a forward PE multiple of 23.8x. Its better-than-expected 3Q17 SSSG, revenue, and EPS (earnings per share) appear to have increased investors’ confidence, leading to a rise in its stock price and valuation multiple.

On the same day, Papa John’s (PZZA) was trading at a forward PE multiple of 20.1x compared to 21.3x before the announcement of its 3Q17 earnings. Papa John’s management’s lowering of its 2017 guidance led to falls in its stock price and forward PE multiple.

Growth prospects

For the next four quarters, analysts expect Domino’s, Yum! Brands, and Papa John’s to post EPS rises of 23.8%, 6.8%, and 2.2%, respectively. These estimates may have been baked in to their respective current stock prices. If these pizza companies fail to meet analysts’ estimates in the next four quarters, selling pressures could bring down their prices and valuation multiples.

Next, we’ll take a look at analysts’ recommendations for these companies.