Ozempic Could Boost Novo Nordisk’s Revenue Growth in 2018

In December 2017, the U.S. FDA (Food and Drug Administration) approved Novo Nordisk’s (NVO) Ozempic as an addition to diet and exercise for the improvement of blood sugar levels in individuals with type two diabetes mellitus.

Jan. 8 2018, Updated 9:01 a.m. ET

Recent approvals

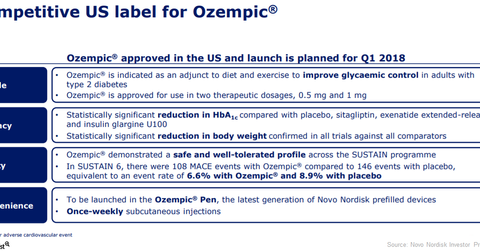

In December 2017, the U.S. FDA (Food and Drug Administration) approved Novo Nordisk’s (NVO) Ozempic as an addition to diet and exercise for the improvement of blood sugar levels in individuals with type two diabetes mellitus. The US FDA approval of Ozempic was based on the results of the SUSTAIN clinical trial. In the SUSTAIN clinical trial program, Ozempic demonstrated clinically meaningful and statistically significant reductions in HbA1c compared to the placebo, sitagliptin, exenatide extended-release, and insulin glargine U100.

In December 2017, the Committee for Medicinal Products for Human Use (or CHMP) of the European Medicines Agency (or EMA) gave a positive opinion in regards to marketing authorization of Ozempic for the treatment of individuals with type two diabetes mellitus. Growth of Ozempic sales could boost the BLDRS Developed Markets 100 ADR Index Fund (ADRD). ADRD invests 2.2% of its total portfolio holdings in Novo Nordisk.

Analyst recommendations

One analyst was tracking Novo Nordisk (NVO) in December 2017 and recommended a “strong buy.” On December 29, 2017, Novo Nordisk had a consensus 12-month target price of $60.4, which represents a 12.5% return on investment over the next 12 months.

Peer ratings

Three analysts were tracking Sanofi (SNY) in December 2017. One of them recommended a “strong buy,” while two analysts recommended a “hold.” On December 29, 2017, Sanofi had a consensus 12-month target price of $49.5, which represents a ~15.1% return on investment over the next 12 months.

24 analysts were tracking Eli Lilly (LLY) in December 2017. Five analysts recommended a “strong buy,” while nine analysts recommended a “buy.” Nine analysts recommended a “hold,” and one of them recommended a “sell” for Eli Lilly in December 2017. On December 29, 2017, Eli Lilly had a consensus 12-month target price of $92.14, which represents a ~9.1% return on investment.

23 analysts were covering Merck (MRK) in December 2017. Six of them recommended a “strong buy,” while seven analysts recommended a “buy” and the rest recommended a “hold.” On December 29, 2017, Merck had a consensus 12-month target price of $65.2, which represents a 15.9% return on investment over the next 12 months.