VMware’s Share Buyback Program

As part of VMware’s (VMW) share repurchase program, the company has bought back ~$5.4 billion in shares in the last five years.

June 1 2018, Updated 10:31 a.m. ET

Share buyback trend

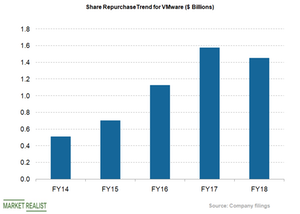

As part of VMware’s (VMW) share repurchase program, the company has bought back ~$5.4 billion in shares in the last five years. This represents an average of ~1.1 billion shares bought each year. Strong free cash flow coupled with low leverage were among the factors that allowed the company to implement its buyback program.

In the graph above, we can see VMware’s share repurchase trend in the last five years. The company maintained a decent buyback trend each year.

The company exited fiscal 2018 with $1.4 billion in share repurchases. In fiscal Q1 2018, it bought back ~$559.0 million in shares compared with ~$169.0 million bought in fiscal Q1 2017.

Factors driving share buybacks

At the end of February, VMware was left with $900.0 million in shares to be repurchased under its buyback program. The company has generated healthy free cash flow in the last five years, driven by strong revenue growth and huge contract wins. During this period, the virtualization service provider maintained an average free cash flow of ~$256.0 million per year.

In fiscal 2018, VMware’s free cash flow stood at ~$3.0 billion versus $2.2 billion in fiscal 2017. As a part of its capital return policy, VMware paid back nearly 49.0% of its free cash flow to its investors through share repurchase.

At the end of December 2017, industry peers Citrix (CTXS) and International Business Machines (IBM) bought back shares worth $1.2 billion and $700.0 billion, respectively.