How Kansas City Southern Beat Revenue Estimate in 4Q17

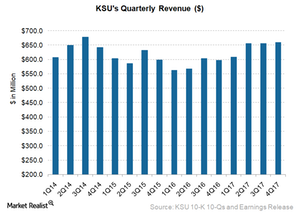

In the fourth quarter 2017, Kansas City Southern (KSU) reported revenue of $660.4 million, exceeding analysts’ revenue estimates by 0.6%.

Dec. 4 2020, Updated 10:51 a.m. ET

Kansas City Southern’s 4Q17 revenue

In the fourth quarter of 2017, Kansas City Southern (KSU) beat analysts’ revenue estimates. It reported revenue of $660.4 million, exceeding the estimates by 0.6%. On a YoY (year-over-year) basis, its 4Q17 revenue rose 10.3% compared to $598.5 million in the corresponding quarter of 2016.

KSU’s 2017 revenue was $2.6 billion, a 10.7% rise from $2.3 billion in 2016. In the last 12 quarters, it hasn’t seen a double-digit rise in revenue.

What led to the rise in 4Q17 revenue?

Kansas City Southern achieved a 10% revenue growth in 4Q17 on a 5% rise in carload growth. Volumes grew to 585,600 carloads in 4Q17 from 552,000 in 4Q16. On an overall unit basis, revenue grew 4.4% from $1,037 per unit to $1,083 per unit in 4Q17. Solid growth in carloads of chemicals and petroleum, energy-related commodities, and automotive led to revenue growth in 4Q17.

Chemical and petroleum revenues rose 24% in 4Q17, riding on 12% higher carloads and an increase of 11% in revenue per unit. Automotive revenues rose 15% in 4Q17 on 5% carload gains and a 9% rise in revenue per unit. Energy-related commodities saw a 15% rise in revenue and a 3% growth in carloads. Their revenue per unit rose 11% in 4Q17.

Industrial and consumer revenue rose 8% in 4Q17 on a double-digit (10%) growth in carloads. However, the per unit revenue fell 1%, indicating pricing pressure in hauling these commodities. The revenue rise was offset by a 1% decline in agriculture and minerals revenue. The carloads of this commodity group fell 9% on a yearly basis in 4Q17.

Management outlook for 2018

Kansas City Southern is optimistic about 90% of its total traffic in 2018. The company expects petroleum (UNG) shipments to grow due to the Mexican energy reforms. Plastic volumes are anticipated to gain momentum in the second half of 2018. In intermodal, it foresees benefits from higher volumes at the Port of Lázaro Cárdenas. Tight truck capacities in the United States could also push the intermodal business in that region.

Automotive freight volumes could grow in line with the Mexican production estimates in 2018. In industrial and consumer, metal carloads are expected to shine this year, although paper volumes could remain neutral. The closure of coal-fired power plants in Texas could pull down utility coal volumes for KSU in 2018. The company anticipates uncertainty in fractionating sand hauling. However, crude oil shipment growth is expected to continue in 2018, as we saw in 4Q17.

In the next part of this series, we’ll take a look at Kansas City Southern’s 4Q17 operating margins.