Why the Future Belongs to Digital Assets

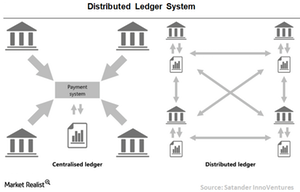

In DLT (distributed ledger technology), details of the transactions are recorded in multiple places called blocks. These blocks are then chained together on a shared network.

Jan. 23 2018, Updated 5:49 p.m. ET

Jan van Eck, CEO, and Gabor Gurbacs, Director, Digital Assets Strategy, at VanEck, recently responded to questions regarding the potential and the challenges of the digital assets and current bitcoin boom. The following Q&A includes highlights from this wide-ranging discussion.

VanEck

What are digital assets?

Digital assets are based on a shared database technology called “distributed ledgers” and represent a variety of uses. Cryptocurrencies, like traditional currencies, are meant to be a store of value. Bitcoin is the most widely recognized cryptocurrency, and has become known as a form of “digital gold”.

Not all digital assets are designed to be currencies. Rather, many are similar to shared applications that are either a technology platform or have a specific function. For example, digital assets can track land ownership or music rights, or allocate resources like computer storage or Wi-Fi bandwidth. They can also act as a platform for “smart contracts”. Tokens work like airline miles or Starbucks rewards — they are only valuable in a specific program or system.

Basically these applications are technology investments. One has to determine if this is the next way of structuring data on the Internet. The appeal is being “permissionless” (anyone can join), having a lower cost, and not being controlled by a company. Digital assets can proliferate like smartphone apps, resulting in fast growth.

Market Realist

Distributed ledger technology

Digital assets contain information in the form of applications, software, content, virtual property, and digital currency. Most digital assets are based on distributed ledger technology (or DLT), which records transactions of assets in digital form. DLT encompasses shared data storage, peer-to-peer networking, and cryptography. Blockchain is one of the most popular distributed ledger technologies (VGT) (IYW). Bitcoin (ARKW) uses Blockchain technology.

In DLT, like blockchain (SOXL) (SOXX), details of the transactions are recorded in multiple places called blocks. These blocks are then chained together on a shared network. Unlike traditional databases, these transactions are recorded and accessed without any third-party regulator or provider. Blockchain is a decentralized system since servers that store the data are spread all over the world. There is no central hub for data storage.

Numerous applications

DLT technology is revolutionizing the way transactions are being recorded and accessed. DLT can also be used to record data such as registry or transactions. Apart from cryptocurrency, this technology has applications in areas such as land records, tax collection, financial transactions, and the distribution of social benefits.