What to Expect from U.S. Steel Corporation’s 4Q17 Shipments

U.S. Steel Corporation’s 4Q17 European shipments could be higher—compared to the sequential quarter. Steel demand tends to be slow in the third quarter.

Jan. 25 2018, Updated 3:20 p.m. ET

U.S. Steel Corporation’s 4Q17 shipments

Steel companies’ revenues are a function of shipments and average steel selling prices (NUE) (MT). As a result, investors should follow quarterly shipment profiles. In this part, we’ll look at the different factors that could impact U.S. Steel Corporation’s (X) 4Q17 shipments. The company is scheduled to release its 4Q17 financial results on January 31, 2018.

Seasonality

The fourth quarter is usually seasonally slower for US steel demand (XME). Demand from key end users like the automobile and construction sectors tends to be lower in the fourth quarter—compared to the third quarter. During the 3Q17 earnings call, AK Steel (AKS) noted that its 4Q17 steel shipments are expected to be lower—compared to 3Q17.

Guidance

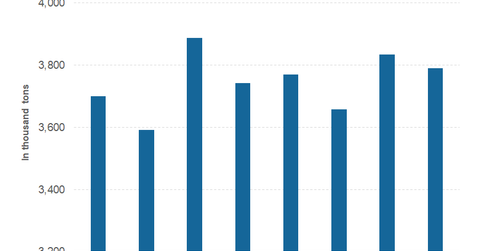

U.S. Steel Corporation expects its fiscal 2017 flat-rolled steel shipments to be ~10 million tons. The company shipped 7.45 million tons in the first nine months of the year. Given the guidance, U.S. Steel Corporation’s 4Q17 flat-rolled shipments could be flat compared the shipments in 3Q17. However, the company’s 4Q17 European shipments could be higher—compared to the sequential quarter. Europe’s steel demand tends to be slow in the third quarter.

In U.S. Steel Corporation’s Tubular segment, the 4Q17 shipments could be similar to the sequential quarter. However, the segment’s average steel selling prices could be lower compared to 3Q17. Next, we’ll look at the different factors that could impact U.S. Steel Corporation’s 4Q17 average selling prices.