Verizon Aims to Improve Its Leverage Target in 2019

Verizon Communications plans to have a leverage of 1.75x–2.0x in 2019. The company ended 2018 with a net debt-to-adjusted EBITDA of 2.1x.

March 22 2019, Published 11:31 a.m. ET

Leverage guidance

Verizon Communications (VZ) plans to have a leverage of 1.75x–2.0x in 2019. The company ended 2018 with a net debt-to-adjusted EBITDA of 2.1x—compared to 2.4x by the end of 2017.

Last month, during the Morgan Stanley Technology, Media, and Telecom Conference, Matt Ellis, Verizon’s CFO, said, “We’re certainly closer to that target range and any time since we did the Vodafone transaction, and we will continue to manage for that balance sheet. But yes, so invest in the business, dividends’ important and strength in the balance sheet.”

Verizon’s debt levels

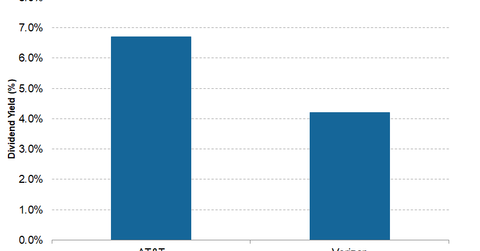

As of December 31, 2018, Verizon’s total debt was $113.1 billion—compared to $117.1 billion at the end of December 31, 2017. However, Verizon remains committed to paying higher dividends. In 2018, the company returned $9.8 billion to shareholders in the form of dividends—compared to $9.5 billion in 2017. As of March 20, Verizon’s dividend yield was ~4.2%. Verizon’s dividend yield was lower than AT&T’s (T) dividend yield at ~6.7%. T-Mobile (TMUS) and Sprint (S) don’t pay dividends.

In 2018, Verizon reported a free cash flow balance of $17.7 billion—compared to $7.1 billion in 2017, which supported its generous dividend payout. The cash flow from operations rose ~41.2% year-over-year to $34.3 billion in 2018. The total capital expenditures were $16.7 billion in 2018—compared to $17.2 billion in 2017.