Analyzing U.S. Steel Corporation’s 4Q17 Earnings Call

During the 4Q17 earnings call, analysts will carefully watch U.S. Steel Corporation’s 2018 guidance.

Jan. 26 2018, Updated 10:32 a.m. ET

U.S. Steel’s 4Q17 earnings call

U.S. Steel Corporation (X) is scheduled to release its 4Q17 financial results on January 31, 2018. The company should hold its earnings conference call on February 1. Previously in this series, we discussed U.S. Steel Corporation’s 4Q17 earnings estimates. In this part, we’ll look at key updates that markets might watch in U.S. Steel Corporation’s 4Q17 earnings call.

Operating plans

As we noted previously, the findings of the Section 232 imports probe have been given to President Trump. During the 4Q17 earnings call, markets look for cues about how much more tonnage U.S. Steel Corporation could offer in the spot market if President Trump takes steps to curb US steel imports. Notably, U.S. Steel Corporation has idled some of its plants and shelved its electric arc furnace project amid sagging US steel prices (XME).

Earnings guidance

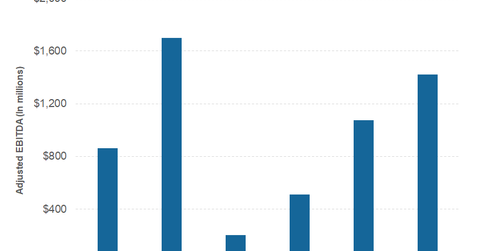

U.S. Steel Corporation and Cleveland-Cliffs (CLF) provide their annual EBITDA (earnings before interest, tax, depreciation, and amortization) guidance during their earnings calls. Nucor (NUE) and Steel Dynamics (STLD) usually provide their quarterly earnings guidance two weeks before the quarter ends. During the 4Q17 earnings call, analysts will carefully watch U.S. Steel Corporation’s 2018 guidance. Although the guidance is subject to change as the year progresses, it provides crucial insight into U.S. Steel Corporation’s earnings capacity.

Analysts polled by Thomson Reuters expect U.S. Steel Corporation to post an adjusted EBITDA of $1.42 billion in 2018. Notably, U.S. Steel Corporation’s EBITDA guidance tends to have an impact on how markets value the stock. Next, we’ll see how markets are valuing U.S. Steel Corporation before its 4Q17 earnings.