These Were Bill Ackman’s Largest Sector Holdings in 3Q17

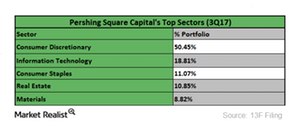

Pershing Square Capital Management’s top sectors in 3Q17 were consumer discretionary (XLY), information technology (XLK), consumer staples (XLP), real estate (IYR), and materials (XLB).

Nov. 20 2020, Updated 12:00 p.m. ET

Bill Ackman’s largest sector holdings in 3Q17

In the previous parts of this series, we analyzed Bill Ackman’s largest stock holdings in 3Q17. In this part, we’ll look at Bill Ackman’s largest sector holdings during the quarter.

Pershing Square Capital Management’s top sectors in 3Q17 were consumer discretionary (XLY), information technology (XLK), consumer staples (XLP), real estate (IYR), and materials (XLB). These sectors represented 50.5%, 18.8%, 11.1%, 10.9%, and 8.8%, respectively, of the firm’s portfolio in 3Q17.

Consumer discretionary

The consumer discretionary sector generally performs well amid economic growth, wage growth, and rising income levels. The demand for various luxury products also increases when these indicators are strong.

Bill Ackman’s strong position in the consumer discretionary sector suggests that he is optimistic about economic growth. The Consumer Discret Sel Sect SPDR ETF (XLY), which tracks the performance of the US consumer discretionary sector, rose 22.4% in 2017.

The information technology sector was the firm’s second-largest holding in 3Q17. The information technology sector remained the top-performing sector of the S&P 500 Index (SPX-INDEX) (SPY) in 2017. The Technology Select Sector SPDR ETF (XLK), which tracks the US technology sector, rose 19.5% in 2017.

For more analysis, read Jim Chanos on Tax Reform, the Health Care Sector, and Short Bets.