AK Steel Could See More Upside after the Strong Rally

AK Steel (AKS) has gained sharply since mid-December. The stock, which traded weak for most of 2017, has shown strength in the past month.

Jan. 18 2018, Updated 4:25 p.m. ET

AK Steel

AK Steel (AKS) has gained sharply since mid-December. The stock, which traded weak for most of 2017, has shown strength in the past month. In this part, we’ll see what analysts expect for AK Steel after its strong rally.

Analysts’ recommendations

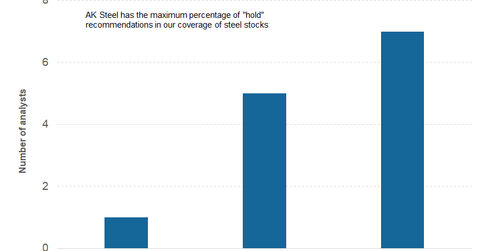

AK Steel received a mean consensus target price of $6.75 from analysts polled by Thomson Reuters. Based on the January 17 closing prices, this represents 1.5% upside. One analyst has a “strong buy” rating on AK Steel, while five analysts have a “buy” rating or some equivalent. The remaining seven analysts have a “hold” rating on AK Steel.

Several analysts revised AK Steel’s target price this month. On January 4, Cowen and Company raised AK Steel’s target price from $4 to $7. On January 9, Jefferies downgraded AK Steel to a “hold.” Morgan Stanley raised AK Steel’s target price from $5.5 to $7. On January 16, Deutsche Bank cut AK Steel’s target price from $8 to $7. While Deutsche Bank cut AK Steel’s target price, it raised Nucor’s (NUE) target price, as we noted in the previous part.

Divergence

There seems to be a divergence in analysts’ opinion after AK Steel’s sharp rally. Markets (CLF) (XME) will look forward to AK Steel’s earnings release on January 30. AK Steel is expected to post revenues of $1.44 billion in 4Q17. To put this in context, it posted revenues of $1.49 billion in 3Q17 and $1.42 billion in 4Q16.

AK Steel’s 4Q17 adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) is expected to be $50 million. It posted an adjusted EBITDA of $69 million in 3Q17 and $151 million in 4Q16.

Next, we’ll see how analysts rate U.S. Steel Corporation (X).