US Dollar Index Is Weak Early on December 13

In the early hours on Wednesday, the US Dollar Index is weak and trading below the opening prices. At 3:50 AM EST, it was trading at 94—a fall of 0.11%.

Dec. 14 2017, Updated 12:37 p.m. ET

US Dollar Index

After trading with strength for two trading weeks, the US Dollar Index started this week on a mixed note. The US Dollar Index rose to four-week high price levels on Tuesday but opened lower today. In the early hours on Wednesday, the US Dollar Index is weak and trading below the opening prices.

Market sentiment

Optimism about economic growth and tax reform plans improved the market sentiment on the US Dollar Index. On Tuesday, the US Dollar Index rose amid the release of the upbeat producer price index and optimism before the FOMC’s interest rate decision. The market’s risk appetite fell amid the election between the Republican candidate Roy Moore and Democrat Doug Jones. The results of the election could have an impact on the pace of the Trump Administration’s proposed economic reforms.

At 3:50 AM EST on December 13, the US Dollar Index was trading at 94—a fall of 0.11%.

US Treasury yields

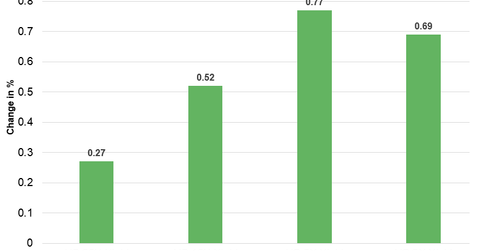

After trading with mixed sentiment last week, US Treasury yields started this week on a stronger note. Treasury yields gained in the first two trading days and traded with strength in the early hours on Wednesday.

Below are the movements in Treasury yields as of 3:55 AM EST on December 11.

- The ten-year Treasury yield was trading at 2.378—a fall of ~0.22%.

- The 30-year Treasury yield was trading at 2.768—a fall of ~0.26%.

- The five-year Treasury yield was trading at 2.140—a fall of ~0.24%.

- The two-year Treasury yield was trading at 1.799—a fall of ~0.02%.

The iShares 20+ Year Treasury Bond (TLT) fell 0.04%. The ProShares UltraPro Short 20+ Year Treasury (TTT) rose 0.08% and the ProShares UltraShort 20+ Year Treasury (TBT) rose 0.03% on December 12.

Next, we’ll discuss how commodities performed in the early hours on December 13.