How the US Dollar Index and Treasury Yields Performed on December 28

The US Dollar Index broke its three-week-long gaining steak this week and fell to three-week low price levels on Wednesday.

Dec. 29 2017, Updated 7:36 a.m. ET

US Dollar Index

The US Dollar Index broke its three-week-long gaining steak this week and fell to three-week low price levels on Wednesday. The US Dollar Index started Thursday on a weaker note and traded at three-month low price levels in the early hours.

The US dollar has been weak amid profit booking, interest rate hikes, and progress in the tax cut bill. On Wednesday, the weaker-than-expected economic data weighed on the US dollar. As per the Conference Board, December’s US CB Consumer Confidence fell to 122.1, which is less than the expected reading of 128. In addition to this, the pullback in Treasury yields also weighed on the US Dollar Index this week. At 4:40 AM EST on December 28, the US Dollar Index was trading at 92.71, a fall of 0.34%.

US Treasury yields

After surging higher in last week, the US Treasury yields lost strength this week. The Treasury yields fell lower on December 26 and December 27 and closed at one-week low price levels. On Thursday, the Treasury yields opened the day higher and were trading above opening prices in the early hours.

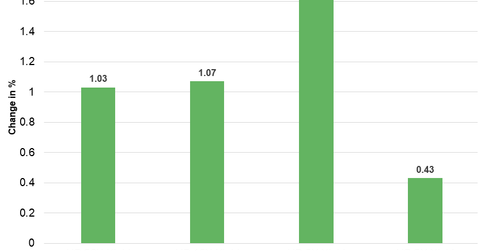

The movements in Treasury yields as of 4:25 AM EST on December 20 are as follows:

- The ten-year Treasury yield was trading at 2.44, a rise of ~1.1%.

- The 30-year Treasury yield was trading at 2.78, a rise of ~1.0%.

- The five-year Treasury yield was trading at 2.23, a rise of ~1.6%.

- The two-year Treasury yield was trading at 1.9, a rise of ~0.43%.

The iShares 20+ Year Treasury Bond (TLT) rose 1.3%. The ProShares UltraPro Short 20+ Year Treasury (TTT) fell 3.9% and the ProShares UltraShort 20+ Year Treasury (TBT) fell 2.5% on December 27.

Next, we’ll discuss how commodities performed in the early hours of December 28.