The Outlook on Phosphate Fertilizer Remains Dull

Similar to what we saw for potash and nitrogen fertilizers, the prices for phosphate fertilizers such as DAP (diammonium phosphate) have suffered as a result of excess capacity.

Dec. 5 2017, Updated 7:33 a.m. ET

Current phosphate environment

Phosphate supply and demand

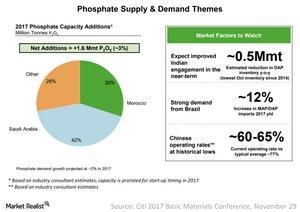

Capacity additions are not over yet. In 2017, 1.6 million metric tons of capacity are expected to be added globally. That’s about a 3% growth in capacity year-over-year to ~55 million metric tons in 2017. About 42% of capacity is expected to come online in Saudi Arabia followed by 30% in Morocco, which has the largest resource of phosphate rock, a key input material for phosphate fertilizers. The remaining 28% of capacity is expected to be added by other regions of the world.

The overall global demand for phosphate fertilizers is expected to grow 2% year-over-year, with Brazil’s demand expected to rise as much as 12% over that period. India will also contribute to this demand with an expectation of lower inventory. However, phosphate capacity additions are expected to grow faster at 3% compared to the demand growth of 2% in 2017.

Phosphate price outlook

The outlook for phosphate prices remains weak. PotashCorp’s (POT) CEO (chief executive officer) Jochen Tilk said that in comparison to potash and nitrogen, the company is less bullish for its phosphate fertilizer environment. The company’s outlook is based on the expectation of newer capacity additions. That’s despite expectations that Chinese producers will have their operating rates at 60%–65%, which will be lower than the average of 77%, according to PotashCorp.