This Oil-Tracking ETF Fell the Most Last Week

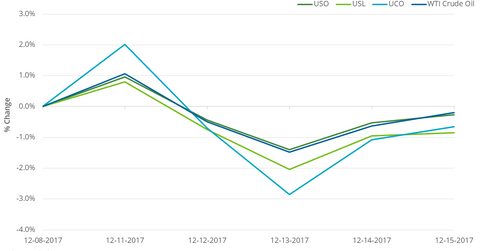

Between December 8 and December 15, the United States Oil Fund (USO)—which invests in crude US oil near-month futures contracts—fell 0.3%.

Dec. 19 2017, Updated 7:33 a.m. ET

Oil ETFs

Between December 8 and December 15, the United States Oil Fund (USO)—which invests in crude US oil near-month futures contracts—fell 0.3%. USO’s fall was 10 basis points more than US crude oil February 2018 futures’ fall during this period.

The United States 12-Month Oil Fund ETF (USL) invests in US crude oil futures contracts until January 2019. It fell 0.8% in the past five trading sessions. The ProShares Ultra Bloomberg Crude Oil ETF (UCO) fell 30 basis points—more than twice the decline in US crude oil futures over this period—as per its objective to meet double the daily ups and downs of the Bloomberg WTI Crude Oil Subindex. USL fell more than USO and UCO.

From February 2016

Between February 11, 2016, and December 15, 2017, US crude oil active futures rose 118.6%. On February 11, 2016, US crude oil (OIIL)(DBO) active futures settled at $26.21 per barrel—the lowest in the last 12 years. USO, USL, and UCO gained 43.4%, 40.1%, and 63.4%, respectively, from oil’s multi-year low.

The difference in US crude oil active futures’ returns and the ETFs’ return could be because of the negative roll yield. The price difference between two consecutive futures contracts creates the roll yield. If the roll yield is negative because of active futures being priced at less than the next month’s futures, it would result in a loss for these ETFs. Read Is the Oil Market Reacting to Oversupply Fears? to understand more.

On December 15, 2017, the closing prices of US crude oil futures contracts between February 2018 and January 2019 were in a descending slope. This type of pricing could benefit these ETFs.

Particularly in UCO’s case, the compounding effect of daily price fluctuations could also cause a difference between the actual and the expected returns.