Oil ETFs That Outperformed US Crude Oil Last Week

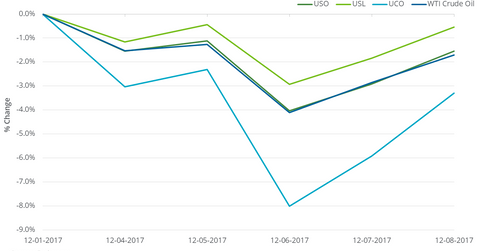

On December 1–8, 2017, the United States Oil Fund (USO), which holds crude US oil futures contracts, fell 1.5%. US crude oil January 2018 futures fell 1.7%.

Dec. 12 2017, Updated 9:04 a.m. ET

Oil ETFs

On December 1–8, 2017, the United States Oil Fund (USO), which holds crude US oil futures contracts, fell 1.5%. US crude oil January 2018 futures fell 1.7% between these two dates.

The United States 12-Month Oil Fund ETF (USL) fell 0.5%. USL holds US crude oil futures contracts for delivery until December 2018. The ProShares Ultra Bloomberg Crude Oil ETF (UCO) fell almost double the fall in US crude oil futures. It matched its objective to provide twice the daily changes of the Bloomberg WTI Crude Oil Subindex. UCO underperformed USO and USL.

From the 12-year low

Between February 11, 2016, and December 8, 2017, US crude oil active futures rose 118.8%. On the former date, US crude oil (OIIL) (DBO) active futures were at their 12-year low. USO, USL, and UCO rose 43.8%, 41.3%, and 64.5%, respectively, from US crude oil’s 12-year low.

The negative roll yield could have restricted the upside movement in these oil tracking ETFs. The roll yield exists because of the price difference between two consecutive futures contracts. If the prices of active futures and the following month’s futures are in ascending order, the ETFs might have losses. Read Are Supply Fears Returning to the Oil Market? to learn more.

On December 8, 2017, US crude oil futures contracts between April 2018 and January 2019 were priced in a descending pattern. The pattern might benefit these ETFs.

For UCO, the compounding effect of daily price fluctuations might cause its actual returns to diverge from its expected returns.