Did Juniper Networks Beat Analysts’ Estimates in 2Q16?

Juniper Networks (JNPR) recently announced its 2Q16 results and reported revenues of $1.22 billion. Revenues rose 11% quarter-over-quarter.

July 29 2016, Published 1:19 p.m. ET

Revenues of $1.22 billion in 2Q16

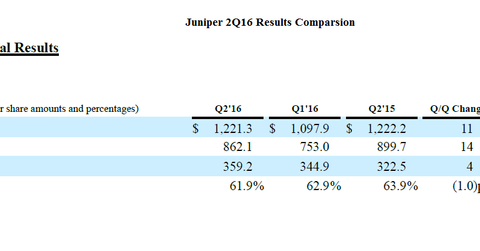

Juniper Networks (JNPR) recently announced its 2Q16 results. It reported revenues of $1.22 billion. Revenues rose 11% sequentially (quarter-over-quarter) but were flat YoY (year-over-year). Juniper’s GAAP (generally accepted accounting principles) operating margin for 2Q16 was 16.7%, compared to 19.9% in 2Q15 and 13.5% in 1Q16. Non-GAAP net income was $191.6 million, and EPS (earnings per share) came in at $0.50 per diluted share in 2Q16.

“Despite an uncertain macro environment, we delivered solid revenue performance and profitability metrics in the second quarter,” said Rami Rahim, CEO of Juniper Networks. “There is no shortage of appetite for network innovation. Our diversification strategy and differentiated portfolio enabled us to deliver sequential growth across all geographies, technologies and sectors.”

Juniper expected revenues of approximately $1.2 billion in 2Q16, which includes $10 million–$15 million in revenues from the BTI Systems acquisition.

Analysts expected revenues of $1.19 billion in 2Q16

Analysts estimated that the company would post revenues of $1.19 billion for the quarter ending in June 2016, with a low estimate of $1.15 billion and a high estimate of $1.22 billion.

EPS were estimated at $0.47, with a high estimate of $0.51 and a low estimate of $0.44.

Juniper is an industry leader in automated, scalable, and secure networks. It has a market capitalization of $8.1 billion. In comparison, its peers Cisco Systems (CSCO), Fortinet (FTNT), and Europe’s (FEP) Ericsson (ERIC) have market caps of $152 billion, $6.4 billion, and $24.8 billion, respectively.