H.B. Fuller Opens a New Facility in Germany

On November 28, 2017, H.B. Fuller (FUL) announced that it has started a new Automotive Competency Center in Mannheim, Germany.

Dec. 4 2017, Published 11:07 a.m. ET

H.B. Fuller’s new facility in Germany

On November 28, 2017, H.B. Fuller (FUL) announced that it has started a new Automotive Competency Center in Mannheim, Germany. This facility facilitates applications laboratory and expanded sales, customer service, and technical service.

This facility will manufacture different forms of adhesive technologies aimed at catering to various automotive companies. Germany, which is known for its automobiles, could be an ideal location for H.B. Fuller.

This facility will increase FUL’s influence in the region and is seen as a major growth strategy. The new facility is expected to contribute to the revenue growth of its Engineering Adhesives segment. In 3Q17, this segment reported a volume growth of 18% on a YoY (year-over-year) basis.

Matt McGreevy, business director of H.B. Fuller’s Global Automotive, stated the following: “This outstanding facility exemplifies our strong commitment to customers in the automotive and automotive electronics industries. The Automotive Competency Center will provide enhanced collaboration capabilities due, in part, to its close proximity to European automotive customers. It also expands our engineering adhesives R&D [research and development] and technical capabilities, and it strengthens our ability to develop new adhesive technologies and applications to support innovation in the broader transportation sector.”

Stock update

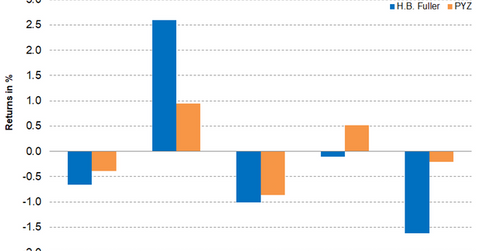

FUL stock rose on the day this news was announced, but for the week ended December 1, 2017, the stock fell 0.90% and closed at $55.65. Although the stock fell for the week, FUL was trading 2.8% above its 100-day moving average price of $54.13, indicating an upward trend in the stock.

On a YTD (year-to-date) basis, FUL has gained a decent 15.2% but has underperformed the broad-based SPDR S&P 500 ETF (SPY), which has gained 18.3% YTD. FUL’s RSI (relative strength index) level of 49 indicates that the stock is neither overbought nor oversold.

Notably, investors can indirectly hold FUL by investing in the PowerShares DWA Basic Materials Momentum Portfolio (PYZ), which has 1.5% of its portfolio in H.B. Fuller. PYZ’s other holdings include Chemours (CC), FMC (FMC), and LyondellBasell (LYB), which had weights of 5.25%, 5.20%, and 5.0%, respectively, as of December 1, 2017.