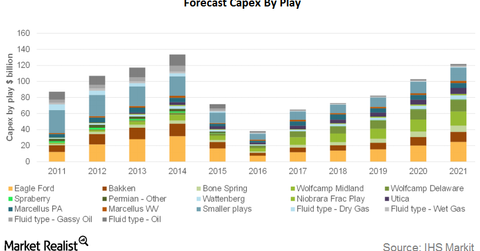

Forecasts for Capital Spending in the Permian Basin

According to a report released by IHS Markit, Permian investments are expected to increase from $8 billion in 2016 to more than $41 billion in 2021.

Dec. 15 2017, Updated 7:11 a.m. ET

Permian capex

According to a report released by IHS Markit, Permian investments are expected to increase from $8 billion in 2016 to more than $41 billion in 2021. That represents a CAGR (compound annual growth rate) of 38%. In comparison, investments in the lower 48 onshore are expected to grow at a CAGR of 27%.

Permian capex (capital expenditure) will represent almost a third of total lower 48 onshore spending through 2021, according to IHS Markit.

For 2018, Chevron’s (CVX) forecast capex in the Permian is expected to be $3.3 billion compared to $2.5 billion in 2017.

Will rising costs be offset by productivity?

However, according to IHS Markit, despite the economic attractiveness of the Permian Basin, in 2017, rising service sector costs will rise per-well capex by more than 15%. Rising costs could also put pressure on break-even prices. To know more, read Part 7 of this series.

That being said, IHS Markit believes that rising costs will likely be offset by increased productivity, especially in the early-life Permian plays. Increasing crude oil prices could also benefit Permian producers.