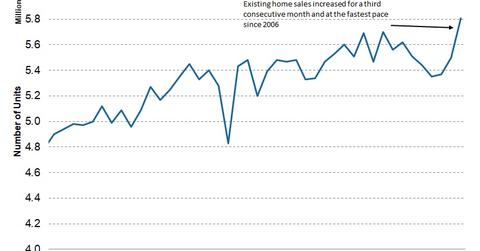

Existing Home Sales: Strongest Pace in 11 Years

According to the latest report from NAR, existing home sales rose 5.6% to a seasonally adjusted annual rate of 5.81 million homes in November.

Dec. 28 2017, Updated 7:32 a.m. ET

National Association of Realtors

The US NAR (National Association of Realtors) releases a monthly report on the existing home sales (ITB) market. The report consists of information about trends in the housing inventory, total housing inventory, median home prices, and the 30-year mortgage rate. Trends in the housing market can be identified through this report. However, the trends can’t be used to predict the housing sector’s (REM) future demand.

According to the latest report from NAR, existing home sales rose 5.6% to a seasonally adjusted annual rate of 5.81 million homes in November—compared to an upward revised 5.50 million homes in October. The gains were spread across the four regions and segments. The average commitment rate for a 30-year mortgage was 3.92%.

Reasons behind the sharp rise in sales

Lawrence Yun, who is NAR’s chief economist, said that strong economic growth in recent quarters, rising stock markets, and the improving job market is fueling the demand for homes. He said that the upper end of the market with higher down payments and better inventory has a better chance of being closed.

Trends in the housing market

November is the 69th consecutive month that home prices have increased. The median home price (FTY) across the US is $248,000—5.8% higher than the previous year. First-time buyers fell to 29% of the total sales in November—compared to 32% in the previous month.

The housing inventory has fallen 7.2% in November to 1.67 million units. The unsold inventory is a 3.4–month supply. A reading below five months denotes a tight housing (EQR) market.

Elizabeth Mendenhall, NAR’s president, said that the proposed changes might not have a major impact on demand. She said that only 6% of homeowners have mortgages above $750,000 and only 5% pay more than $10,000 in property taxes. The bottom line is that the housing market (IYR), in its current state, looks solid. Demand is increasing faster than supply. It looks like 2018 could be another positive year.