Tronox Completes the Sale of Alkali Chemicals Business

On September 1, 2017, Tronox (TROX) announced that it had completed the previously announced sale of its alkali chemicals business to Genesis Energy (GEL).

Sept. 5 2017, Updated 7:37 a.m. ET

Tronox completes the sale of alkali business

On September 1, 2017, Tronox (TROX) announced that it had completed the previously announced sale of its alkali chemicals business to Genesis Energy (GEL). The sale will fetch Tronox approximately $1.3 billion. The majority of the proceeds from the sale of the alkali business will be used to fund the Cristal Tio2 acquisition.

The sale of the alkali chemical business will impact TROX revenue and earnings at least for the next two quarters, as the acquisition of Cristal is expected to be completed in 1Q18. The business reported revenue of $201 million in 2Q17 and income from operations of $23 million. With the acquisition of Cristal and the sale of its alkali chemical business, Tronox will primarily be dealing with titanium dioxide.

Tronox CEO, Peter Johnston, said, “The sale of Alkali Chemicals is an important step in positioning Tronox as the global leader in the titanium dioxide (TiO2) industry. The proceeds will be used to fund the majority portion of the cash consideration for the acquisition of the TiO2 assets of Cristal, which is expected to close by the first quarter of 2018.”

Tronox stock performance for the week ended September 1

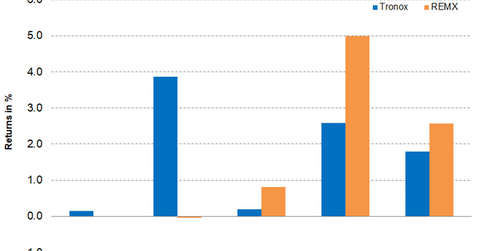

Tronox had a strong week and closed at $21.06, a 52-week high on a closing basis. TROX rose 4.7% for the week ended September 1, 2017, outperforming peers Albemarle (ALB) and FMC (FMC), which rose 3.2% and 3.7% respectively. However, Tronox underperformed Chemours (CC), which returned 5.0% for the same period. The gains have resulted in Tronox stock trading 22.7% above its 100-day moving average price of $17.17. On a year-to-date basis, the stock has returned 105%. Tronox’s relative strength index of 72 indicates that the stock has temporarily moved into an overbought situation. An RSI of above 70 indicates that the stock is overbought.

Investors can indirectly hold Tronox by investing in the Rare Earth/Strategic Metals ETF (REMX), which has invested 6.2% of its portfolio in TROX as of September 1, 2017.