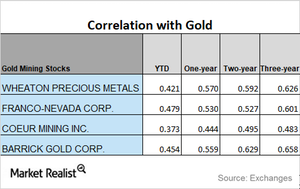

What Direction Is the Correlation of Miners Headed?

On a year-to-date basis, AngloGold has seen the highest correlation to gold, while Cia De Minas has the lowest year-to-date correlation.

Dec. 26 2017, Updated 2:10 p.m. ET

Miners’ correlation with gold

Gold is regarded as the most influential precious metal, and most miners are known to follow its price trends. In this part of the series, we’ll look at Cia De Minas Buenaventura (BVN), AngloGold Ashanti (AU), Hecla Mining (HL), and Kinross Gold (KGC).

The prices of mining-based funds are also closely related to those of precious metals. The Physical Swiss Gold Shares ETF (SGOL) and the Physical Silver Shares ETF (SIVR) had risen 0.25% each on Wednesday, December 20, as all precious metals were trending higher.

These funds posted five-day gains of 0.79% and 0.70%, respectively. They have a high correlation to the two core precious metals.

Reading the trends

On a YTD (year-to-date) basis, AngloGold has seen the highest correlation to gold, while Cia De Minas has the lowest YTD correlation. The YTD correlation seems to be moderately lower than in previous years.

Among the four miners that we are discussing, BVN, HL, and KGC have seen downward movement in their correlation to gold. AU has seen a mixed reaction during the past three years.

The correlation of KGC dropped from a three-year correlation of 0.66 to a one-year correlation of 0.54. A correlation of 0.54 suggests that about 54% of the time, Kinross Gold moved in the same direction as gold over the past one-year period.

A brief analysis of the movement of mining shares to gold is essential, as that provides insight into the future price movement of these miners.