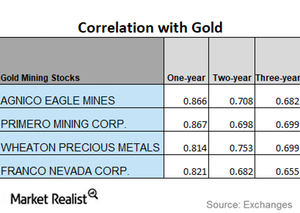

A Correlation Study of Miners in December 2017

If we look at the YTD (year-to-date) correlations of the select mining shares to gold, there has been a reasonable fall.

Dec. 5 2017, Updated 4:00 p.m. ET

Correlation brief

Gold is prominent among the four precious metals. The other three precious metals closely track the price changes in gold and react accordingly. It’s important that investors analyze how miners are moving compared to precious metals. In this part, we’ll focus on a correlation study.

We’ll assess Buenaventura Mining (BVN), AngloGold Ashanti (AU), Eldorado Gold (EGO), and Alacer Gold (ASR) and their correlations to gold.

If we look at the YTD (year-to-date) correlations of the select mining shares to gold, there has been a reasonable fall. This year has been fairly unpredictable for price reactions for mining shares. They usually follow the price trend in gold, but that’s not always the case.

Mining-based funds that have a strong correlation with precious metals include the VanEck Vectors Gold Miners ETF (GDX) and the iShares MSCI Global Gold Miners (RING). They have YTD gains of 4.1% and 3.8%, respectively.

Trend analysis

Among the four miners we’re analyzing, ASR, EGO, and BVN have seen their correlations fall over the past three years. AU has seen a mixed performance during the same time frame. An increase in the correlation suggests that the miner is being influenced more by the price changes in gold.

BVN’s three-year correlation of 0.53 has fallen to a one-year correlation of 0.38. A correlation of 0.53 indicates that in the past year, BVN has been taking cues from gold ~53% of the time. It suggests that a rise in gold leads to an increase in BVN ~53% of the time.