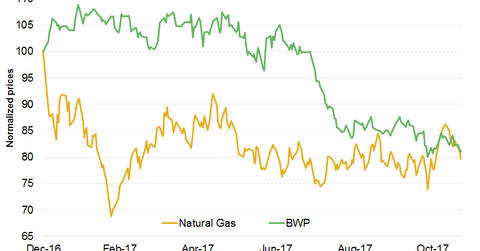

How BWP Correlates with Natural Gas

Boardwalk Pipeline Partners (BWP), a midstream MLP mainly involved in natural gas and NGLs transportation and storage, ranks second among MLPs in terms of correlation with natural gas.

Dec. 1 2017, Updated 12:50 p.m. ET

BWP versus natural gas

Boardwalk Pipeline Partners (BWP), a midstream MLP mainly involved in natural gas and NGLs transportation and storage, ranks second among MLPs in terms of correlation with natural gas. BWP’s three-month correlation with natural gas was 0.40 as of November 27, 2017. On the other hand, BWP’s three-month correlation with crude oil is -0.04.

BWP has minimal direct natural gas exposure due to its fee-based contracts. However, the partnership’s business is still impacted by movement in natural gas prices. The fluctuation in natural gas price impacts the natural gas drilling activity, which in turn impacts BWP’s throughput volumes. A decline in natural gas demand from residential customers and power utilities impacts both the natural gas prices and BWP’s throughput volumes. A decline in throughput volumes impacts BWP’s earnings and stock price. Moreover, the partnership is affected by the basis differential between Henry Hub and other locations.

Analysts’ recommendations

Goldman Sachs recently initiated coverage on BWP with a “sell” rating. Overall, the partnership has seen two rating changes in 2017 including one downgrade and one new coverage initiation. Now, 45.5% of analysts rate BWP a “hold,” 36.4% rate it a “buy,” and the remaining 18.2% rate it a “sell.” BWP is currently trading below the low range ($14) of analysts’ target prices. BWP’s average target price of $17.7 implies ~31% upside potential from the current price levels.

In the next article, we’ll look into the correlation between Dorchester Minerals (DMLP) and natural gas.