How Wendy’s Valuation Multiple Compares to Its Peers

The initiatives taken by Wendy’s management to drive SSSG appear to have led to a rise in WEN stock and a higher valuation multiple.

Feb. 28 2018, Updated 7:31 a.m. ET

Valuation multiple

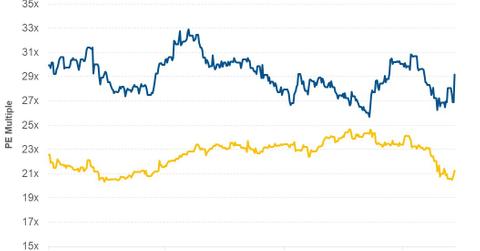

A valuation multiple helps investors compare companies with similar business models. Due to the high visibility of Wendy’s (WEN) earnings, we have opted for the forward PE (price-to-earnings) multiple. A forward PE multiple is calculated by dividing a company’s current stock price with analysts’ EPS (earnings per share) estimates for the next four quarters.

Wendy’s forward PE multiple

The initiatives taken by Wendy’s management to drive SSSG (same-store sales growth), including the expansion of its delivery service, image activation, digital innovations, and the introduction of new menu items, appear to have led to a rise in WEN stock and a higher valuation multiple. As of February 23, 2018, Wendy’s was trading at a forward PE multiple of 29.2x compared to 26.9x before the announcement of its 4Q17 earnings.

On the same day, its peers McDonald’s (MCD), Jack in the Box (JACK), and Restaurant Brands International (QSR) had PE multiples of 21.2x, 18.6x, and 21.9x, respectively.

Growth prospects

The above-mentioned initiatives are expected to increase Wendy’s expenditures. If these initiatives fail to increase sales, the increased expenditure could put pressure on the company’s earnings. For the next four quarters, analysts are expecting EPS to rise 30.2%, which could have been factored into the company’s current stock price. If the company fails to post earnings in line with analysts’ estimates, the selling pressure could bring down the stock and the valuation multiple.

Next, we’ll look at analysts’ recommendations for Wendy’s.