What Weighed down AK Steel’s 3Q17 Performance?

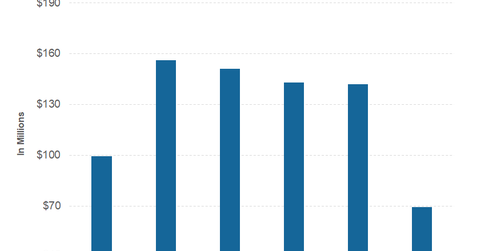

AK Steel (AKS) reported adjusted EBITDA of $69.2 million in 3Q17, compared with $142 million in 2Q17 and $157 million in 3Q16.

Dec. 4 2020, Updated 10:53 a.m. ET

3Q17 financial performance

AK Steel (AKS) reported adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) of $69.2 million in 3Q17, compared with $142 million in 2Q17 and $157 million in 3Q16. Thus, AK Steel’s 3Q17 EBITDA fell sharply on a yearly as well as a sequential basis.

The company’s 3Q17 EBITDA missed consensus estimates by a wide margin. While steel peers Nucor (NUE) and Steel Dynamics (STLD) also reported sequentially lower EBITDA in 3Q17, AK Steel witnessed the biggest percentage decline among the major steel stocks (CLF) (MT) that we’re covering in this series.

Higher input costs

AK Steel blamed higher input costs for its lower 3Q17 profits. According to AK Steel, “Higher raw material costs, particularly for scrap, chrome, zinc, and other alloys, contributed to the decline in results compared to the third quarter a year ago. Results for the third quarter of 2017 included a LIFO (last in first out) charge of $49.0 million, which was a $73.2 million year-over-year change from a LIFO credit of $24.2 million in the third quarter a year ago.”

Free cash flows

AK Steel generated negative free cash flows of $86 million in 3Q17. Along with lower earnings, working capital build-up negatively impacted AK Steel’s 3Q17 cash flows. Generally, steel companies don’t see major working capital build-ups in the third quarter.

According to AK Steel, “The change primarily reflects a short-term increase in carbon and stainless steel with and finish goods, that were produced in preparation of a third and fourth quarter maintenance outages at our Mansfield and Middletown facilities.”

In the next and final part of this series, we’ll look at AK Steel’s 4Q17 guidance and other key takeaways from the company’s 3Q17 earnings call.