Perjeta Could Significantly Boost Roche’s Revenue Growth in 2018

In December 2017, the Food and Drug Administration approved Roche’s (RHHBY) Perjeta based on the results of its phase three Aphinity trial.

Jan. 10 2018, Published 1:37 p.m. ET

Recent approval

In December 2017, the US FDA (Food and Drug Administration) approved Roche’s (RHHBY) Perjeta, Herceptin, and chemotherapy combination as adjuvant therapy for individuals with HER2 (human epidermal growth factor receptor 2) plus positive early breast cancer (or eBC) who are at high risk of relapse.

APHINITY trial

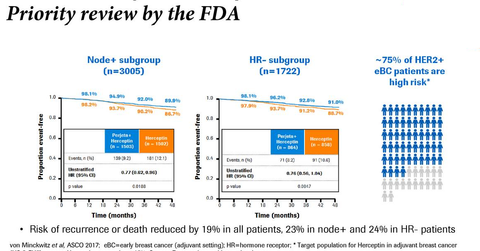

The US FDA approval of Perjeta was based on the results of the phase three APHINITY trial. In the trial, Perjeta, in combination with Herceptin and chemotherapy, demonstrated a significant decrease in the risk of invasive breast cancer relapse or death by 18% compared to Herceptin and chemotherapy alone.

In the phase three APHINITY trial, in the ITT (intent-to-treat) and node-positive subgroups receiving Perjeta in combination with Herceptin and chemotherapy, 94.1% and 92.0% of patients, respectively, achieved invasive disease-free survival (or iDFS) compared to 93.2% and 90.2% of patients on Herceptin and chemotherapy alone.

In the hormone receptor-positive and hormone receptor-negative subgroup, among patients on Perjeta, Herceptin, and chemotherapy, 94.8% and 92.8% of patients achieved iDFS compared to 94.4% and 91.2% of patients on Herceptin and chemotherapy alone.

In the APHINITY trial, in the node-negative subgroup, 97% of patients on Perjeta, Herceptin, and chemotherapy achieved iDFS compared to 98.4% of patients on Herceptin and chemotherapy alone.

In the APHINITY trial, in the lymph node positive subgroup, the lymph node negative subgroup, the hormone receptor-negative subgroup, and hormone receptor positive subgroup, the hazard ratios were 0.77, 1.1, 0.76, and 0.86, respectively.

Perjeta’s peers include Novartis’s (NVS) Tykerb, Puma Biotechnology’s (PBYI) Nerlynx, Celgene’s (CELG) Abraxane, and Eli Lilly’s Gemzar.

The growth in sales of Perjeta could boost the Vanguard International Dividend Appreciation ETF (VIGI). Roche and Novartis make up about ~2.7% and 2.8% of VIGI’s total portfolio holdings.