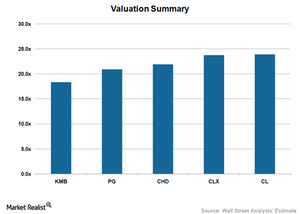

How PG, KMB, CL, CLX, and CHD Compare on Valuation

As of November 24, 2017, Colgate-Palmolive (CL) stock was trading at a forward PE multiple of 24.0x, which is higher than its peers.

Dec. 1 2017, Updated 9:02 a.m. ET

Colgate-Palmolive trades at a premium

As we dig into the valuation of our select set of consumer products companies, note that the forward PE (price-to-earnings) multiple will vary among peers based on numerous factors that include capital structure and growth expectations, among others.

As of November 24, 2017, Colgate-Palmolive (CL) stock was trading at a forward PE multiple of 24.0x, which is higher than its peers. Its current valuation multiple is also higher than the Consumer Staples Select Sector SPDR ETF’s (XLP) forward PE ratio of 20.7x. The S&P 500 Index (SPX-INDEX) was trading at a forward PE multiple of 18.5x. Colgate-Palmolive’s long-term growth rate stands at 7.6%, which is at par with its peers.

In comparison, Kimberly-Clark (KMB) was trading at a forward PE multiple of 18.3x, which is below the peer group average of 22.7x. However, the company’s low valuation isn’t attracting investors, given the top-line and bottom-line headwinds that are projected to restrict its growth rate.