Is Oil Bullishness Boosting Oil ETFs?

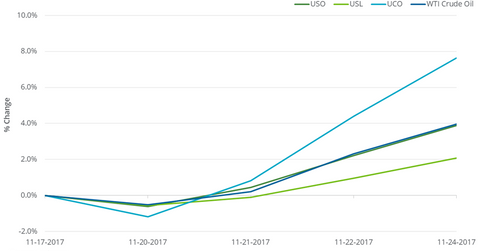

Between November 17 and November 24, 2017, the United States Oil Fund LP (USO), which tracks WTI crude oil near-month futures, rose 3.9%.

Nov. 27 2017, Updated 3:50 p.m. ET

Crude oil ETFs

Between November 17 and November 24, 2017, the United States Oil Fund (USO), which tracks WTI crude oil near-month futures, rose 3.9%. During this period, US crude oil active futures rose 3.9%.

The United States 12-Month Oil Fund ETF (USL) rose 2.1%. The ETF aims to follow US crude oil futures contracts 12 months out, starting with the active futures contract. The ProShares Ultra Bloomberg Crude Oil ETF (UCO) rose 7.6%, almost on par with its objective to produce twice the daily changes of the Bloomberg WTI Crude Oil Subindex. It outperformed crude oil and other oil ETFs.

Since 2016

Between February 11, 2016, and November 24, 2017, US crude oil active futures more than doubled. On February 11, 2016, US crude oil (OIIL) (DBO) active futures were at their 12-year low. However, USO, USL, and UCO rose only 47.5%, 42.5%, and 73.5%, respectively, between February 11, 2016, and November 24, 2017.

These ETFs’ underperformance could be because of the negative roll yield. The variation in prices between two consecutive near-month futures contracts results in a roll yield. If active futures are priced lower than the following month’s futures contract, these ETFs could see losses. For more, read Are Oil Oversupply Concerns Letting Up?

However, on November 24, 2017, US crude oil futures contracts prices for the next one year settled at progressively lower prices, which could boost these ETFs.

UCO’s actual returns could also vary from its expected returns because of the compounding effect of its daily price fluctuations.