How Did the Mobileye Acquisition Impact Intel’s Balance Sheet?

Intel (INTC) is increasing its earnings through spending discipline and by focusing its expenses on projects with high ROI (return on investment).

Dec. 1 2017, Updated 7:30 a.m. ET

Intel’s cash flow

Intel (INTC) is increasing its earnings through spending discipline and by focusing its expenses on projects with high ROI (return on investment), spending capital in promising technologies like nonvolatile memory and FPGA (field-programmable gate array), and investing in strategic AI (artificial intelligence) and automotive acquisitions.

In fiscal 3Q17, Intel’s operating cash flow rose 33% sequentially to $6.3 billion, of which it spent $3 billion on capital expenditure, resulting in FCF (free cash flow) of $3.28 billion. Its cash flow rose significantly as it received over $2 billion in prepayments for long-term NAND (negative AND) supply agreements through 2018.

Intel spent $2.4 billion of its FCF on shareholder returns and used the remaining ~$900 million in cash to fund the Mobileye acquisition.

Funding the Mobileye acquisition

Intel completed the acquisition of Mobileye by paying $14.5 billion in cash, of which over 50% was funded from the proceeds of divested assets, while $7 billion came from new debt.

The sales proceeds included $924 million received from the sale of a 51% stake in McAfee, $735 million received in dividends from McAfee, and $2.2 billion worth of promissory notes repaid by McAfee. The sales proceeds also included the amount received from the sale of ASML shares.

Cash and debt position

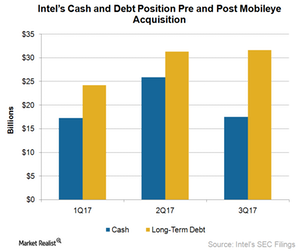

After the Mobileye acquisition, Intel’s cash reserves declined by $8.4 billion to $17.5 billion, and its long-term debt rose by $7.5 billion to $31.6 billion. At the end of fiscal 3Q17, Intel had a net debt position of $14 billion.

Acquisitions have not only increased Intel’s leverage but also its competitors’ leverage. Qualcomm (QCOM), which has always operated in a net cash position, will likely operate in a net debt position after it completes the acquisition of NXP Semiconductors (NXPI) in early 2018. Broadcom (AVGO) is already operating in a net debt position, but that didn’t stop it from making a bid of over $100 billion for Qualcomm.

Given this scenario, Intel’s high leverage is still manageable as its high FCF could service its debt without impacting its earnings significantly.

In the next part, we’ll discuss what analysts have to say about Intel’s financial position.