A Look at Cisco’s Profit Margin and Revenue Growth

Analysts expect Cisco’s revenues to rise 0.3% YoY to $48.1 billion in fiscal 2018, compared with its revenues of $48 billion in fiscal 2017.

Nov. 9 2017, Updated 12:58 p.m. ET

Analysts expect Cisco’s revenue to rise marginally in fiscal 2018

Analysts expect Cisco’s (CSCO) revenues to rise 0.3% YoY (year-over-year) to $48.1 billion in fiscal 2018, compared with its revenues of $48 billion in fiscal 2017. Cisco’s revenues are also expected to rise 1.8% in fiscal 2019 on a YoY basis to $49 billion.

Cisco’s non-GAAP (generally accepted accounting principles) EPS (earnings per share) could rise 1.7% YoY in fiscal 2018 to $2.43 and 4.9% YoY to $2.55 in fiscal 2019. Analysts expect the revenues of peers Juniper Networks (JNPR), Nokia (NOK), IBM (IBM), and Ericsson (ERIC) to rise 0.7%, -2.9%, -1.6%, and -8.9%, respectively, in their next fiscal years.

Profit margins

Analysts expect Cisco to post a GAAP net margin of 21%, with an operating margin of 31.3%, in fiscal 2018. The firm reported a net margin of 20%, with an operating margin of 31.6% in fiscal 2017.

Profit margins are, however, expected to rise in 2019 and 2020, driven by Cisco’s rise in revenue. While analysts expect Cisco’s revenues to rise 0.3% in 2018, its net margin is expected to rise to 21.1%, with an operating margin of 31.6%. Cisco’s operating margin and net margin are expected to be 22.5% and 32.2%, respectively, in 2020, compared with its revenue growth of 3.6% YoY.

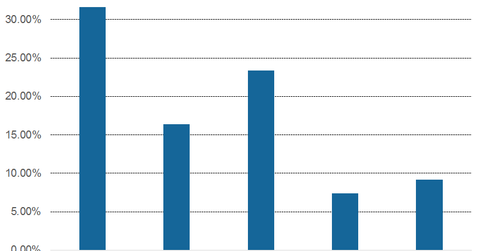

Peers Juniper (JNPR), Ericsson (ERIC), IBM (IBM), and Nokia (NOK) had operating margins of 23.4%, 7.4%, 16.4%, and 9.2%, respectively, at the end of their last reported fiscal quarters.