Assessing Ericsson’s Challenges and Opportunities in Its Networks Business

Ericsson (ERIC) has estimated that the RAN (radio access network) market will decline in the medium term and be flat by 2020.

Dec. 4 2017, Updated 10:31 a.m. ET

The decline in the RAN market

Ericsson (ERIC) has estimated that the RAN (radio access network) market will decline in the medium term and be flat by 2020. The firm has seen a decline in its market share in RAN, and its profitability has been impacted by competition and pricing pressures.

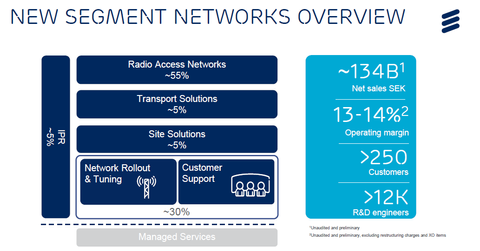

RAN accounts for 55% of the total revenues from its Networks segment. Ericsson has estimated that its RAN revenues will fall 8% YoY (year-over-year) in 2017, 2% YoY in 2018, and 1% YoY in 2019.

Meanwhile, Ericsson aims to invest in R&D (research and development) to achieve cost and technology leadership. Its strategic priorities include a focus on competitiveness for selective market expansion and the acceleration of 5G.

Ericsson would like to re-establish a technology differentiation through faster innovation that would positively impact its gross margins as well. Ericsson aims to expand its operating margin in this segment to between 15% to 17% in 2020, up from 13%.

Expansion opportunities

According to Ericsson, traffic growth (mobile and devices) has risen over 70% YoY (year-over-year) in 2017. Spectrum allocations could double worldwide to accommodate 5G and LTE (long-term evolution).

Currently, over 50% of the world’s population does not have access to LTE, which provides an opportunity for Ericsson, Nokia (NOK), Cisco Systems (CSCO), and China’s (FXI) Huawei to target underdeveloped economies. Ericsson is also optimistic about market expansion and growth in areas such as IoT (Internet of Things), 5G, mission-critical communications, and wireless.