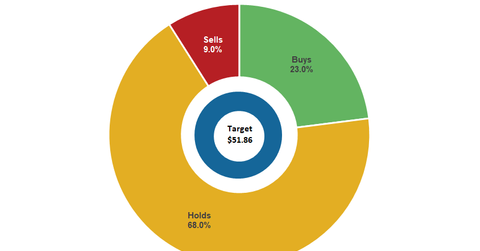

Analysts’ Recommendations on HOG before Its 4Q17 Results

According to data compiled by Reuters, 68% of analysts covering Harley-Davidson stock gave it “hold” recommendations.

Nov. 20 2020, Updated 4:42 p.m. ET

Harley-Davidson

Iconic motorcycle maker Harley-Davidson (HOG) maintained the highest US market share in the heavyweight motorcycle segment (IYK) in 2017. Last year, the company’s stock underperformed other auto stocks and lost about 12.8%.

In 2018 so far, HOG has risen ~4.2% as of January 19. This YTD (year-to-date) performance could be driven by broader market optimism and positive sentiment in the auto stocks. In comparison, auto stocks Honda (HMC), General Motors (GM), and Fiat Chrysler (FCAU) have risen 6.3%, 5.3%, and 34.1% YTD, respectively.

Analysts’ recommendations on HOG

According to data compiled by Reuters, 68% of analysts covering Harley-Davidson stock gave it “hold” recommendations. Only 23% of these analysts recommended a “buy” while the remaining 9% of analysts maintained a bearish view on the company and gave it a “sell” recommendation. About three months ago, ~18% of these analysts gave it a “buy” recommendation.

On January 19, analysts’ consensus target price for the company was $51.86 for the next 12 months. This price target was already much lower than its market price of $53.00, reflecting no upside potential.

Recent optimism

A solid recovery of ~11.0% in HOG stock has been witnessed in the last three months, especially after it declared its 4Q17 dividends on November 28.

In 3Q17, HOG reported a 37.5% drop in its earnings but managed to beat analysts’ estimates by a narrow margin. Similarly, the company’s third-quarter revenues fell ~12.0% YoY (year-over-year) during the quarter. Its gross profit margin shrank to 28.8% from 33.6% in 3Q16.

Despite its weakening profitability, the company is focusing on cost reduction efforts and plans to launch several new bikes in the next few years. These could be among the reasons why many analysts still giving a “buy” on HOG ahead of its 4Q17 results, which are scheduled to be released on January 30.

Continue to the next part where we’ll compare automakers’ valuation multiples before the auto industry’s 4Q17 earnings season begins.