How Amazon Keeps Growing

Amazon.com (AMZN) posted its fiscal 3Q17 numbers last week, handily beating its earnings and revenue estimates.

Aug. 18 2020, Updated 5:18 a.m. ET

Amazon’s earnings and revenue beats

Amazon.com (AMZN) posted its fiscal 3Q17 numbers last week, handily beating its earnings and revenue estimates. The company generated revenues of $43.7 billion—34% higher YoY (year-over-year) and above Wall Street’s estimate of $42.14 billion.

Amazon’s acquisition of Whole Foods, which was completed in 3Q17, accounted for $1.3 billion of revenues in fiscal 3Q17. The company’s retail growth was driven by “Prime Day” sales, its annual discount day in July.

The tech giant posted net profits of $256 million, or $0.52 per share, while Wall Street estimated $0.03 per share. Amazon’s actual earnings are typically not close to the analysts’ estimates. In fiscal 2Q17, the company’s EPS (earnings per share) missed expectations by a big margin because the company aggressively reinvests what it makes.

Amazon’s AWS continues to control IAAS cloud market

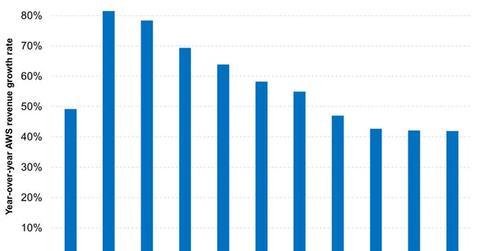

The company’s revenue growth was powered by its cloud segment. AWS (Amazon Web Services) saw revenues of $4.57 billion in 3Q17, which was higher than analysts’ estimates of $4.51 billion and 41.9% higher than its AWS revenue in 3Q16. AWS is Amazon’s most profitable division and allows the company to keep reinvesting in other businesses.

According to Synergy Research Group, Amazon’s AWS still controls 35% of the cloud market share, though Microsoft’s (MSFT) Azure is growing at a much faster rate.