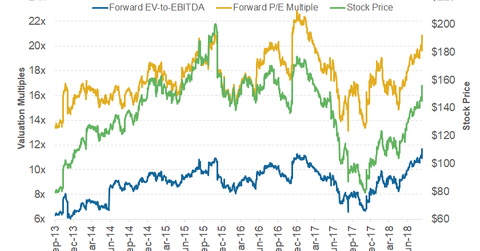

Advance Auto Parts’ Valuation Multiples in Q3 2018

As of August 14, Advance Auto Parts’ forward EV-to-EBITDA multiple was 10.8x. Currently, Advance Auto Parts’ forward PE multiple is 20.8x.

Aug. 17 2018, Updated 9:02 a.m. ET

Valuation multiples

Valuation multiples are commonly used in the automotive and auto industry to compare different businesses entities. We can only use valuation multiples to compare companies that are similar in nature in terms of size or financials.

Advance Auto Parts’ (AAP) valuation multiples can be compared with peers like O’Reilly Automotive (ORLY) and AutoZone (AZO).

Forward valuation multiples

As of August 14, Advance Auto Parts’ forward EV-to-EBITDA multiple was 10.8x. The multiple was lower than O’Reilly Automotive’s forward EV-to-EBITDA multiple of 13.6x and higher than AutoZone’s multiple of 9.8x. To calculate the multiples, we took the consensus estimated next 12-month EBITDA for the respective companies.

Currently, Advance Auto Parts’ forward PE multiple is 20.8x—higher than 17.1x about three months ago. The multiple was also higher than O’Reilly Automotive’s forward PE multiple of 19.1x and AutoZone’s forward PE multiple of 13.5x.

In general, automakers’ (XLY) valuation multiples including General Motors (GM) and Fiat Chrysler (FCAU) trade much lower than auto parts retailers’ multiples. General Motors and Fiat Chrysler had forward EV-to-EBITDA multiples of 8.0x and 1.7x, respectively.

Key factors to watch in the third quarter

Unlike the auto manufacturing business, the auto parts retail business has relatively lower investment requirements to drive future growth. As a result, Advance Auto Parts’ risk profile is lower, which could be a positive factor for its valuation.

A continuation of the recovery seen in Advance Auto Parts’ second-quarter sales and profitability could raise its earnings growth estimates for upcoming quarters. The continued positive sales trend could impact the company’s valuation multiples in the coming quarters.

Next, we’ll discuss analysts’ recommendations for Advance Auto Parts stock after its second-quarter earnings.