Precious Metals and Companies That Mine Them

Precious metal miners got a boost on Tuesday, October 3, 2017, despite the marginal fall of precious metals.

Oct. 5 2017, Published 11:22 a.m. ET

Mining companies

Precious metal miners got a boost on Tuesday, October 3, 2017, despite the marginal fall of precious metals. When considering investing in mining stocks, it’s important to look at the technicals of miners and analyze their credibility.

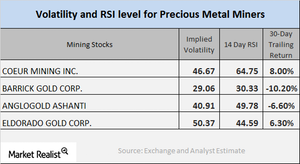

Let’s compare the volatility figures and RSI (relative strength index) levels of Coeur Mining (CDE), Barrick Gold (ABX), Anglogold Ashanti (AU), and Eldorado Gold (EGO).

Volatility indicators

Call implied volatility is used to analyze the fluctuations in the price of a stock with respect to changes in the price of its call option. On October 3, 2017, Coeur Mining, Barrick Gold, Anglogold Ashanti, and Eldorado Gold had implied volatilities of 46.7%, 29.1%, 40.9%, and 50.4%, respectively. We should keep in mind that the volatilities of mining companies are usually higher than the volatilities of precious metals.

RSI indicator

An RSI (relative strength index) level measures whether a stock is overbought or oversold. If a stock’s RSI is above 70, it could be overbought, and its price could decline. If a stock’s RSI is less than 30, it could be oversold and the price might rise.

The RSI levels of Coeur Mining, Barrick Gold, Anglogold Ashanti, and Eldorado Gold are 64.8, 30.3, 49.8, and 44.6, respectively. The recent falls in their stock prices have led to considerable falls in their RSI levels.

In addition to reading the performances of mining stocks, it’s also crucial to understand mining funds such as the VanEck Vectors Gold Miners ETF (GDX) and the iShares MSCI Global Gold Miners (RING). They closely follow the price changes in metals and have seen year-to-date rises of 7.4% and 10.6%, respectively.