How Fast Food Restaurants’ Valuation Multiples Stack Up

Wendy’s (WEN) has been trading above its peers’ valuation multiple.

Oct. 4 2017, Updated 9:08 a.m. ET

Valuation multiple

Due to high visibility in fast food companies’ earnings, we have opted for a forward PE multiple for our analysis. The forward PE multiple is calculated by dividing the company’s stock price from analysts’ earnings estimate for the next four quarters.

Forward PE multiple

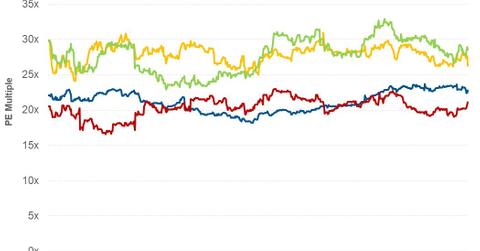

From the above graph, we can see that Wendy’s (WEN) has been trading above its peers’ valuation multiples. The refranchising of company-owned restaurants has led analysts to forecast lower EPS (earnings per share) for the next four quarters, which has increased the company’s forward PE multiple. As of September 28, 2017, Wendy’s (WEN) was trading at 28.6x.

Wendy’s is followed by Restaurant Brands International (QSR) with a forward PE multiple of 26.3x compared to 26.9x before the announcement of 2Q17 earnings. Despite the rise in QSR’s stock price, the valuation multiple has fallen due to an increase in analysts’ earnings estimates for the next four quarters. The strong 2Q17 earnings could have compelled analysts to raise their EPS estimates.

As of September 28, 2017, McDonald’s (MCD) was trading at 22.8x compared to 22.7x before the announcement of 2Q17 earnings. The strong 2Q17 earnings appear to have increased investors’ confidence, leading to a rise in the company’s stock price and its valuation multiple.

On the same day, Jack in the Box (JACK) was trading at 21.1x compared to 19.7x before the announcement of 2Q17 earnings. The improvement in Jack in the Box’s same-store sales growth in 2Q17 appears to have increased investors’ confidence, leading to a rise in the company’s stock price and forward PE multiple.

Next, we’ll look at analysts’ recommendations and their target prices for fast food companies.