Why Did Hewlett-Packard Split Its Business?

Hewlett-Packard split into HP Inc. and Hewlett Packard Enterprise. On the first day of trading, the companies’ shares moved in opposite directions.

Nov. 3 2015, Updated 3:59 p.m. ET

The Hewlett-Packard split

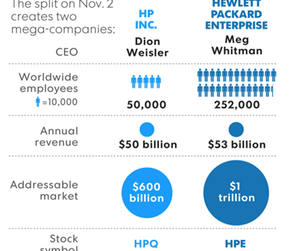

Founded in 1939, the Silicon Valley pioneer Hewlett-Packard has finally split into two. On November 2, 2015, Hewlett-Packard split into HP Inc. (HPQ) and Hewlett Packard Enterprise (HPE). Shares of the two independent entities started trading on the New York Stock Exchange on November 2, 2015. On the first day of trading, the companies’ shares moved in opposite directions. HP Inc.’s shares rose 13% to close at $13.83 while Hewlett Packard Enterprise’s fell 1.6% to close at $14.49. Explore this series to understand the details of the split, challenges, and future growth prospects for each entity.

HP Inc. and Hewlett Packard Enterprise

The split was first announced on October 6, 2014, as part of the company’s five-year plan to turn around its business, which has been hit by the emergence of cloud technology and continued softness in PC (personal computer) shipments. HP Inc. will focus on PCs and printers, while Hewlett Packard Enterprise, or HPE, will focus on servers, storage, the cloud, networking, services, and software.

Unlike rival IBM (IBM), which is more focused on software, HPE will focus on hardware. It will face tough competition from the combined entity created from the Dell-EMC (EMC) merger.

Strategy behind the split

The split does not guarantee a solution to HP’s troubles. But with shares down almost 30% in 2015 alone, the split was the best option to deliver value to shareholders.

Although it’s believed that the split was initiated to free up the enterprise business from the sluggish PC business, some analysts have a different opinion. Some analysts are upbeat about HP Inc. and expect HPE to become an acquisition target in the long term. However, HPE chief executive officer Meg Whitman denied that HPE might become an acquisition target.

Meg Whitman said that “as two independent, industry-leading companies, Hewlett-Packard Enterprise and HP Inc. can drive more focused business strategies, innovation roadmaps, and go-to-market models. The separation will also present better choices for investors by creating two distinct and attractive investment profiles.”

In the next part of this series, we’ll look at the transaction details of the split and its impact on shareholders and employees. You can invest in HP Inc. through the SPDR S&P 500 ETF (SPY). It has 0.13% exposure in the company’s stock.