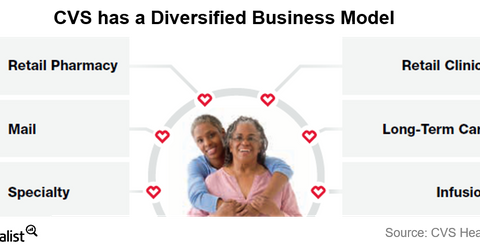

CVS versus Walgreens: Which Has a More Diversified Business Model?

CVS generates close to 70% of its annual sales by offering a full range of pharmacy benefit management services.

Nov. 20 2020, Updated 1:46 p.m. ET

CVS: Top drugstore chain and top PBM operator in the US

In the previous section, we noted that Walgreens Boots Alliance (WBA) has a strong international presence. In comparison, CVS Health (CVS) has a presence mainly in the US and Brazil.

CVS is the largest pharmacy chain in the US, operating ~9,700 pharmacies across the country. In addition to being the top drugstore chain, it is also one of the largest pharmacy benefits managers (PBM) in the country.

CVS is also present in the specialty pharmacy and the long-term care pharmacy space. CVS’s acquisition of Omnicare in 2015 gave the company an entry in the long-term and post-acute care market. Omnicare is currently the leader in this area.

The company is also the largest operator of retail health clinics in the US, with 1,130 clinics under its MinuteClinic banner.

In comparison, Walgreens’ operations are dependent on the pharmacy business, although the company has a presence in the retail and wholesale pharmacy spaces.

CVS Health’s PBM business

CVS generates close to 70% of its annual sales by offering a full range of pharmacy benefit management services. It entered the PBM space with the acquisition of Caremark in 2007. The purchase not only integrated its supply chain but also gave CVS a more extensive reach across the healthcare spectrum.

Walgreens wanted to enter the PBM space through the acquisition of Rite Aid (RAD), which has Envision Pharma under its umbrella. However, the deal was scrapped by the FTC over concerns regarding diminishing competition in the drugstore space.

However, the company formed an alliance with Prime Therapeutics in 2016 to better compete with CVS. Please read the next section to know more.

Investors looking for exposure to Walgreens and CVS can consider the Consumer Staples Select Sector SPDR ETF (XLP), which invests close to 9% of its portfolio in the two companies.