Is Cleveland-Cliffs’ Weak 4Q17 Outlook Temporary?

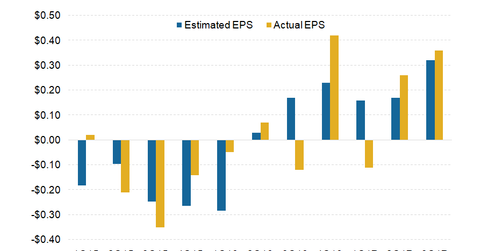

Cleveland-Cliffs (CLF) released its 3Q17 results on October 20. CLF reported earnings per share of $0.36, beating the consensus estimate by $0.04.

Oct. 25 2017, Updated 5:18 p.m. ET

CLF’s 3Q17 earnings

Cleveland-Cliffs (CLF) released its 3Q17 results on October 20, 2017. The company held its conference call with securities analysts and institutional investors that day to discuss the results.

The company’s 3Q17 results beat market expectations. It reported earnings per share (or EPS) of $0.36, beating the consensus estimate by $0.04. Its top line of $698.4 million also surpassed the analysts’ revenue estimate of $672.0 million.

Stock price fell despite the beat

Cleveland-Cliffs (CLF) stock fell ~5% after the results were announced. While its earnings beat market expectations, its management’s commentary during the earnings call portended a weaker-than-expected fourth quarter.

Cleveland-Cliffs also discontinued providing EBITDA[1. earnings before interest, tax, depreciation, and amortization] guidance due to too many assumptions, which have been changing lately. The company has already downgraded its EBITDA guidance twice in 2017 so far. It also downgraded the volumes guidance for its US and Asia-Pacific divisions.

While the company is guiding for a weaker 4Q17 and expects 2018 to improve in terms of demand and pricing, investors may be concerned about its short-term weakness.

Among Cleveland-Cliffs’ US peers (SLX), AK Steel (AKS), U.S. Steel (X), Nucor (NUE), and Steel Dynamics (STLD) are also expected to be impacted by this short-term weakness in the US steel market.

Series overview

Investors can use this series to gauge Cleveland-Cliffs’ (CLF) short-term and long-term fundamentals. In this series, we’ll discuss its 3Q17 results, conference call highlights, management guidance, and outlook. We’ll also see how the company is planning to progress on new growth initiatives.

We’ll start by looking at the economics, construction timeline, and financing of its HBI plant in the next part of this series.