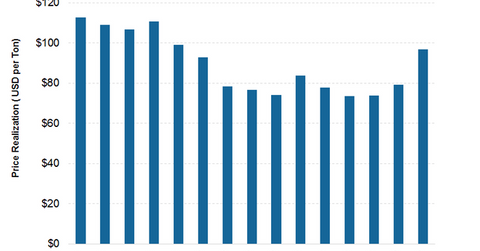

Can Cleveland-Cliffs’ Realized Prices in the US See an Uptick in 3Q17?

Cleveland-Cliffs’ (CLF) average realized prices increased 24% year-over-year and 22% quarter-over-quarter to $97 per ton in 2Q17.

Oct. 16 2017, Updated 10:40 a.m. ET

Realized revenues from USIO

Along with volumes, realized revenues determine the top lines for commodity companies. Realized revenues also help assess the market sentiment, as they are derived from existing market prices.

In turn, these prices are determined by several other market factors. One of these factors is demand, which depends on existing and expected steel prices in the domestic market.

US steel prices

US steel prices (SLX) have been trading in a range-bound manner for the last few months. The prices have been ranging between $610–$630 per ton. Many market participants believe the downside to US steel prices might be limited due to the moderate spreads between the US and international steel prices.

The favorable decision on the Section 232 probe is the largest positive catalyst for steel prices. Under such a scenario, US HRC (hot rolled coil) prices could rise substantially. Higher spot prices could boost the earnings of steelmakers like U.S. Steel Corporation (X), Nucor (NUE), and ArcelorMittal (MT).

Upside to realized revenues

Cleveland-Cliffs’ (CLF) average realized prices increased 24% year-over-year (or YoY) and 22% quarter-over-quarter to $97 per ton in 2Q17. The company’s management had guided for substantially better realized prices in 2Q17. This improvement is due to the new 2017 formulas.

CLF’s carryover tons were also worked off in 1Q17, which supported the liftoff in 2Q17. The company expects improved realizations for the rest of the year as well.

In the next article, let’s look at Cleveland-Cliffs’ Asia-Pacific division.