A Brief Analysis of Mining Stock Correlations with Gold

The iShares MSCI Global Gold Min (RING) and the Sprott Gold Miners (SGDM) rose with metals on Monday, climbing 1.2% and 0.83%, respectively.

Nov. 1 2017, Updated 1:57 p.m. ET

Mining stock correlations

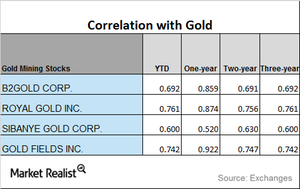

There are a few technical indicators that are crucial in reading the directional moves of mining stocks. Correlation analysis is critical because it gives investors guidance about the potential movements of mining stocks in relation to gold and silver.

Here, we’ll compare Sibanye Gold (SBGL), Gold Fields (GFI), Coeur Mining (CDE), and Barrick Gold (ABX).

Mining funds such as the iShares MSCI Global Gold Min (RING) and the Sprott Gold Miners (SGDM) also tend to track precious metals closely, and their correlation numbers remain considerably high. These two funds rose with metals on Monday, climbing 1.2% and 0.83%, respectively.

Correlation trends

Among the four miners that we’re analyzing here, Barrick Gold has the lowest correlation with gold on a one-year basis, while Gold Fields has the highest correlation with gold. Among these miners, only Gold Fields has seen a rising trend in its correlation with gold over the past three years.

Barrick Gold has seen a downtrend in correlation with gold, while the other three miners have seen a mix of upward and downward trends in their correlations.

Notably, the correlation of Gold Fields with gold has risen from a three-year correlation of 0.74 to a one-year correlation of 0.92. Remember, a correlation of 0.92 suggests that Gold Fields has moved in the same direction as gold ~92% of the time in the past year.

It’s also essential that we remember that correlation trends keep changing, and so investors have to keep tabs on which miners are more closely associated with gold, and which are not.