Behind the Recent Correlation Movements of Precious Metals

Among these four miners, AngloGold has the lowest correlation with gold so far this year, while Coeur Mining has the highest correlation YTD.

Oct. 16 2017, Published 12:00 p.m. ET

Correlation analysis

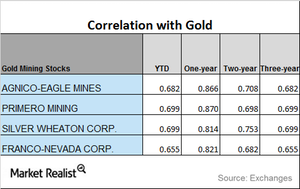

As we analyze mining companies’ technical movements, we have to do a study of the correlation between mining stocks and gold for the full picture. Remember, gold usually determines the direction silver, platinum, and palladium.

Below, we’ll analyze Coeur Mining (CDE), Barrick Gold (ABX), AngloGold Ashanti (AU), and Hecla Mining (HL).

The mining funds that have strong relationships with precious metals include the VanEck Vectors Junior Gold Miners (GDXJ) and the Global X Silver Miners (SIL). GDXJ and SIL have risen 9.8% and 7.1%, respectively, YTD (year-to-date).

Trend analysis

Among the four miners that we’ve selected, AngloGold has the lowest correlation with gold so far this year, while Coeur Mining has the highest correlation YTD. AngloGold’s and Hecla Mining’s correlations have risen over the past three years, while Barrick Gold’s correlation has fallen.

AngloGold has a three-year correlation of 0.49 and a one-year correlation of 0.66. The correlation of 0.66 implies that ~66.0% of the time, AngloGold has moved in the same direction as gold during the past year.

Any increase in correlation with gold is an indicator that the price is more likely to track the directions of precious metals than it been previously.