US Dollar Index and Treasury Yields Are Strong

The US Dollar Index broke its three-week losing streak last week and regained stability. The US Dollar Index opened higher on Monday.

Dec. 4 2017, Published 8:21 a.m. ET

US Dollar Index

The US Dollar Index broke its three-week losing streak last week and regained stability. The US Dollar Index opened higher on Monday and traded with strength above the opening prices in the early hours.

Market sentiment

The market sentiment was mixed last week amid concerns about the tax reform bill. However, the sentiment improved as the Senate passed the tax reform bill over the weekend. The tax reform bill improved the expected corporate profits. The market is looking forward to the release of October’s US Factory Orders data at 10:00 AM EST today.

At 5:20 AM EST today, the US Dollar Index is trading at 93.22—a gain of 0.36%.

US Treasury yields

After trading with mixed sentiment last week, US Treasury yields started this week on a stronger note. The increased risk appetite in the market amid progress in the tax reform bill weighed on bonds. Yields move opposite to the movements in bonds. They traded with strength in the morning session.

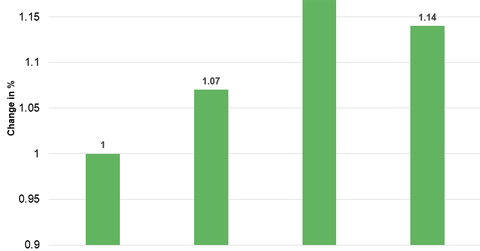

Below are the movements in Treasury yields as of 6:40 AM EST on December 1.

- The ten-year Treasury yield was trading at 2.390—a gain of ~1.15%.

- The 30-year Treasury yield was trading at 2.785—a gain of ~0.94%.

- The five-year Treasury yield was trading at 2.143—a gain of ~1.17%.

- The two-year Treasury yield was trading at 1.798—a gain of ~1.14%.

The iShares 20+ Year Treasury Bond (TLT) rose 1.35%. The ProShares UltraPro Short 20+ Year Treasury (TTT) fell 4.11% and the ProShares UltraShort 20+ Year Treasury (TBT) fell 2.71% on December 1.

In the next part of this series, we’ll discuss how commodities performed in the early hours on December 4.