Chemours: Analyzing Its 3Q17 Dividend

On September 15, 2017, Chemours (CC) will pay the 3Q17 dividend on its outstanding common shares. It has declared a cash dividend of $0.03 per share.

Sept. 13 2017, Published 10:22 a.m. ET

Chemours’ 3Q17 dividend

On September 15, 2017, Chemours (CC) will pay the 3Q17 dividend on its outstanding common shares. Chemours has declared a cash dividend of $0.03 per share. Investors who held the share on or before August 17, 2017, are eligible for the 3Q17 dividend. Chemours’ peers Tronox (TROX) and Kronos Worldwide (KRO) declared a quarterly dividend of $0.05 and $0.15 per share, respectively.

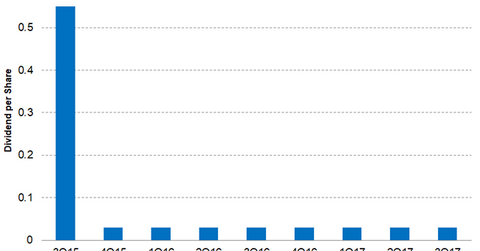

Dividend growth

It’s important to note that Chemours was a spin-off from DuPont. The spin-off was completed on July 1, 2015. In the above graph, you can see that Chemours paid a dividend of $0.55 per share in 3Q15. The dividend was declared before to separation and was paid on September 11. After the separation, Chemours paid the first dividend in 4Q15. Since then, Chemours has maintained the same dividend rate of $0.03 per share, which indicates no dividend growth.

Free cash flow

Positive free cash flows help companies finance dividend payments, expansion activities, share repurchases, and much more. Can Chemours’ free cash flow support its dividend plan? We’ll convert Chemours’ free cash flow into free cash flow per share. At the end of 2Q17, Chemours had a free cash flow per share of $0.45. In 2016, its free cash flow per share was $1.40.

In 2016, Chemours paid a dividend of $0.12 per share, which is 8.60% of the free cash flow per share. At the end of 2Q17, Chemours paid a dividend of 0.06 per share, which is 13.30% of its free cash flow per share. Currently, Chemours’ free cash flow can support its dividend plan.

Investors can hold Chemours indirectly by investing in the PowerShares DWA Basic Materials Momentum Portfolio (PYZ). PYZ has invested 5.10% of its holdings in Chemours. The fund also provides exposure to FMC (FMC) with a weight of 4.70% as of September 11, 2017.

In the next part, we’ll discuss Chemours’ dividend yield and dividend payouts.