Kronos Worldwide Inc

Latest Kronos Worldwide Inc News and Updates

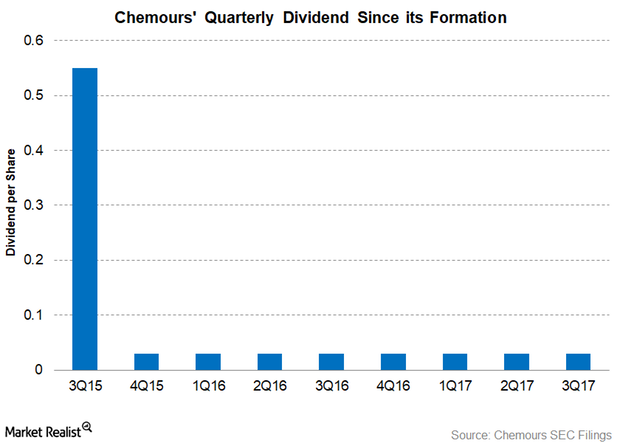

Chemours: Analyzing Its 3Q17 Dividend

On September 15, 2017, Chemours (CC) will pay the 3Q17 dividend on its outstanding common shares. It has declared a cash dividend of $0.03 per share.

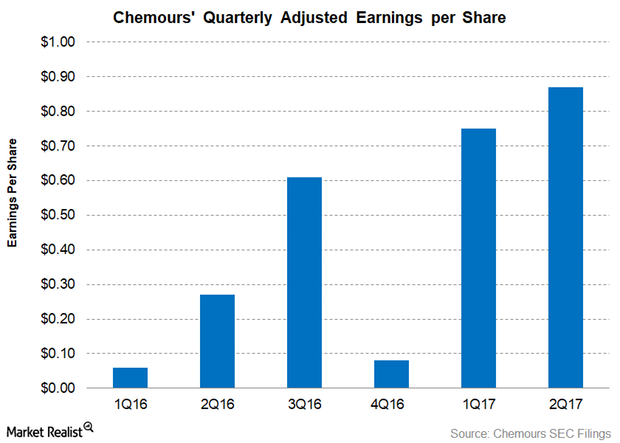

Chemours Stock Fell despite Strong Earnings in 2Q17

Chemours (CC) reported its 2Q17 earnings on August 2, 2017, after the markets closed. The company’s management held a conference call on August 3, 2017.

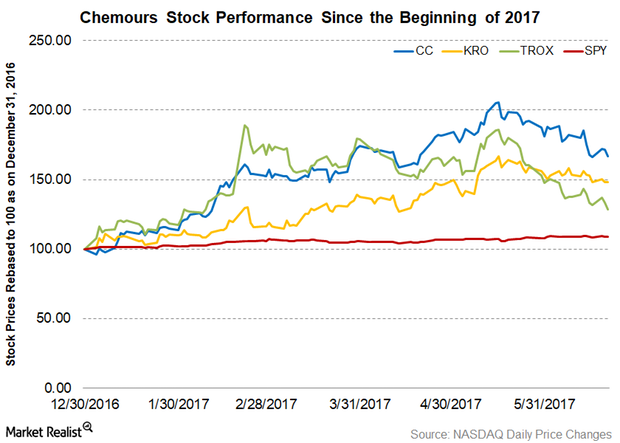

Understanding the Recent Rise in Chemours Stock

Since the beginning of 2017, Chemours (CC) stock has given a tremendous performance, gaining 66.6% YTD as of June 22.